10.1 Aircraft seat allocation problem#

Preamble: Install Pyomo and a solver#

The following cell sets and verifies a global SOLVER for the notebook. If run on Google Colab, the cell installs Pyomo and the HiGHS solver, while, if run elsewhere, it assumes Pyomo and HiGHS have been previously installed. It then sets to use HiGHS as solver via the appsi module and a test is performed to verify that it is available. The solver interface is stored in a global object SOLVER for later use.

import sys

if 'google.colab' in sys.modules:

%pip install pyomo >/dev/null 2>/dev/null

%pip install highspy >/dev/null 2>/dev/null

solver = 'appsi_highs'

import pyomo.environ as pyo

SOLVER = pyo.SolverFactory(solver)

assert SOLVER.available(), f"Solver {solver} is not available."

Problem description#

An airline is deciding how to partition a new plane for the Amsterdam-Buenos Aires route. This plane can seat 200 economy-class passengers. A section can be created for first-class seats, but each of these seats takes the space of 2 economy-class seats. A business-class section can also be created, but each of these takes the space of 1.5 economy-class seats. The profit for a first-class ticket is three times the profit of an economy ticket, while a business-class ticket has a profit of two times an economy ticket’s profit. Once the plane is partitioned into these seating classes, it cannot be changed.

The airline knows that the plane will not always be full in every section. The airline has initially identified three scenarios to consider with about equal frequency:

Weekday morning and evening traffic;

Weekend traffic; and

Weekday midday traffic.

Under Scenario 1 the airline thinks they can sell as many as 20 first-class tickets, 50 business-class tickets, and 200 economy tickets. Under Scenario 2 these figures are 10 , 24, and 175, while under Scenario 3, they are 6, 10, and 150, respectively. The following table summarizes the forecast demand for these three scenarios.

Scenario |

First-class seats |

Business-class seats |

Economy-class seats |

|---|---|---|---|

(1) weekday morning and evening |

20 |

50 |

200 |

(2) weekend |

10 |

24 |

175 |

(3) weekday midday |

6 |

10 |

150 |

Average Scenario |

12 |

28 |

175 |

The goal of the airline is to maximize ticket revenue. For marketing purposes, the airline will not sell more tickets than seats in each of the sections (hence no overbooking strategy). We further assume customers seeking a first-class or business-class seat will not downgrade if those seats are unavailable.

Attribution#

This problem statement is adapted from an exercise and examples presented the following book:

Birge, J. R., & Louveaux, F. (2011). Introduction to stochastic programming. Springer Science & Business Media.

The adaptations include a change to parameters for consistency among reformulations of the problem, and additional treatments for sample average approximation (SAA) with chance constraints.

Problem data#

Pandas DataFrames and Series are used to encode problem data in the following cell, and to encode problem solutions in subsequent cells.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from scipy.stats import norm

# scenario data

demand = pd.DataFrame(

{

"morning and evening": {"F": 20, "B": 50, "E": 200},

"weekend": {"F": 10, "B": 24, "E": 175},

"midday": {"F": 6, "B": 10, "E": 150},

}

).T

# global revenue and seat factor data

capacity = 200

revenue_factor = pd.Series({"F": 3.0, "B": 2.0, "E": 1.0})

seat_factor = pd.Series({"F": 2.0, "B": 1.5, "E": 1.0})

Analytics#

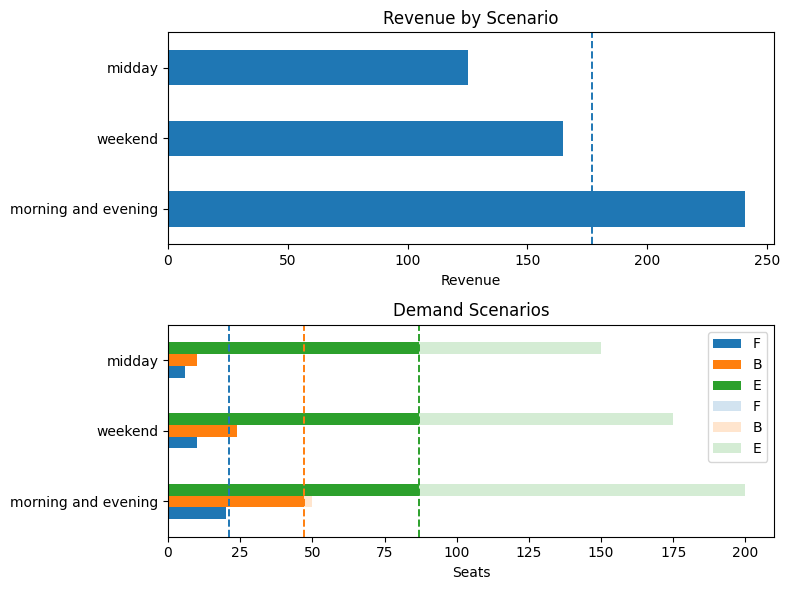

Prior to optimization, a useful first step is to prepare an analytics function to display performance for any given allocation of seats. The first-stage decision variables are the number of seats allocated for each class \(c\in C\). We would like to provide a analysis showing the operational consequences for any proposed allocation of seats. For this purpose, we create a function seat_report() that show the tickets that can be sold in each scenario, the resulting revenue, and the unsatisfied demand (‘spillage’).

To establish a basis for analyzing possible solutions to the airline’s problem, this function first is demonstrated for the case where the airplane is configured as entirely economy-class.

# function to report analytics for any given seat allocations

def seat_report(seats, demand, name=""):

classes = seats.index

# report seat allocation

equivalent_seats = pd.DataFrame(

{

"seat allocation": {c: seats[c] for c in classes},

"economy equivalent seat allocation": {

c: seats[c] * seat_factor[c] for c in classes

},

}

).T

equivalent_seats["TOTAL"] = equivalent_seats.sum(axis=1)

print("\nSeat Allocation")

display(equivalent_seats)

# tickets sold is the minimum of available seats and demand

tickets = pd.DataFrame()

for c in classes:

tickets[c] = np.minimum(seats[c], demand[c])

print("\nTickets Sold")

display(tickets)

# seats unsold

unsold = pd.DataFrame()

for c in classes:

unsold[c] = seats[c] - tickets[c]

print("\nSeats not Sold")

display(unsold)

# spillage (unmet demand)

spillage = demand - tickets

print("\nSpillage (Unfulfilled Demand)")

display(spillage)

# compute revenue

revenue = tickets.dot(revenue_factor)

print(

f"\nExpected Revenue (in units of economy ticket price): {revenue.mean():.2f}"

)

# charts

fig, ax = plt.subplots(2, 1, figsize=(8, 6))

revenue.plot(ax=ax[0], kind="barh", title="Revenue by Scenario")

ax[0].plot([revenue.mean()] * 2, ax[0].get_ylim(), "--", lw=1.4)

ax[0].set_xlabel("Revenue")

tickets[classes].plot(

ax=ax[1], kind="barh", rot=0, stacked=False, title="Demand Scenarios"

)

demand[classes].plot(

ax=ax[1],

kind="barh",

rot=0,

stacked=False,

title="Demand Scenarios",

alpha=0.2,

)

for c in classes:

ax[1].plot([seats[c]] * 2, ax[1].get_ylim(), "--", lw=1.4)

ax[1].set_xlabel("Seats")

fig.tight_layout()

return None

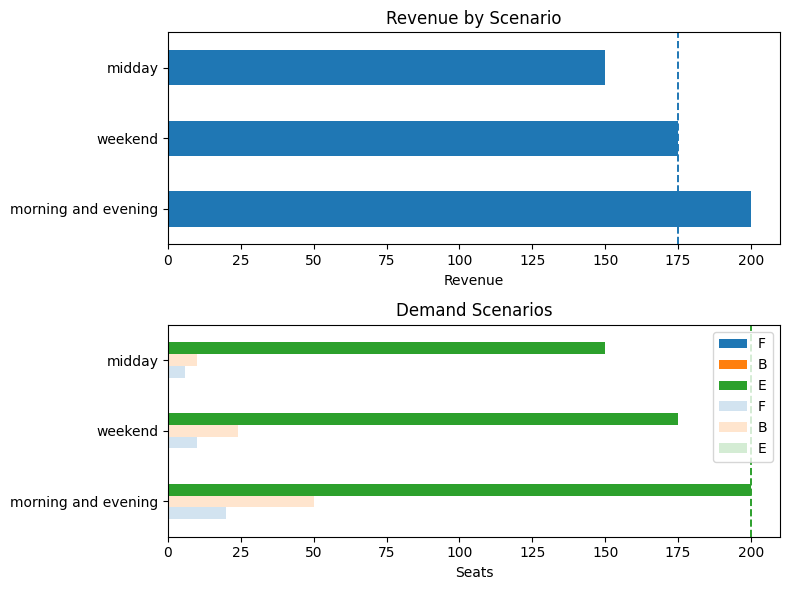

# trivial solution (all seats in economy) and report

seats_all_economy = pd.Series({"F": 0, "B": 0, "E": 200})

seat_report(seats_all_economy, demand)

Seat Allocation

| F | B | E | TOTAL | |

|---|---|---|---|---|

| seat allocation | 0.0 | 0.0 | 200.0 | 200.0 |

| economy equivalent seat allocation | 0.0 | 0.0 | 200.0 | 200.0 |

Tickets Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 0 | 0 | 200 |

| weekend | 0 | 0 | 175 |

| midday | 0 | 0 | 150 |

Seats not Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 0 | 0 | 0 |

| weekend | 0 | 0 | 25 |

| midday | 0 | 0 | 50 |

Spillage (Unfulfilled Demand)

| F | B | E | |

|---|---|---|---|

| morning and evening | 20 | 50 | 0 |

| weekend | 10 | 24 | 0 |

| midday | 6 | 10 | 0 |

Expected Revenue (in units of economy ticket price): 175.00

Model 1. Deterministic solution for the average demand scenario#

A common starting point in stochastic optimization is to solve the deterministic problem where future demands are fixed at their mean values and compute the corresponding optimal solution. The resulting value of the objective has been called the expectation of the expected value problem (EEV) by Birge, or the expected value of the mean (EVM) solution by others.

Let us introduce the set \(C\) of the three possible classes, i.e., \(C=\{F,B,E\}\). The objective function is to maximize ticket revenue.

where \(r_c\) is the revenue from selling a ticket for a seat in class \(c\in C\).

Let \(s_c\) denote the number of seats of class \(c \in C\) installed in the new plane. Let \(f_c\) be the scale factor denoting the number of economy seats displaced by one seat in class \(c \in C\). Then, since there is a total of 200 economy-class seats that could fit on the plane, the capacity constraint reads as

Let \(\mu_c\) be the mean demand for seats of class \(c\in C\), and let \(t_c\) be the number of tickets of class \(c\in C\) that are sold. To ensure we do not sell more tickets than available seats nor more than demand, we need to add two more constraints:

Lastly, both ticket and seat variables need to be nonnegative integers, so we add the constraints \(\bm{t}, \bm{s} \in \mathbb{Z}_+\).

The following cell presents a Pyomo model implementing this model.

def aircraft_deterministic(demand):

m = pyo.ConcreteModel("Aircraft seat allocation - Deterministic")

m.CLASSES = pyo.Set(initialize=demand.columns)

# first stage variables and constraints

m.seats = pyo.Var(m.CLASSES, domain=pyo.NonNegativeIntegers)

@m.Constraint(m.CLASSES)

def plane_seats(m, c):

return sum(m.seats[c] * seat_factor[c] for c in m.CLASSES) <= capacity

# second stage variable and constraints

m.tickets = pyo.Var(m.CLASSES, domain=pyo.NonNegativeIntegers)

@m.Constraint(m.CLASSES)

def demand_limits(m, c):

return m.tickets[c] <= demand[c].mean()

@m.Constraint(m.CLASSES)

def seat_limits(m, c):

return m.tickets[c] <= m.seats[c]

# objective

@m.Objective(sense=pyo.maximize)

def revenue(m):

return sum(m.tickets[c] * revenue_factor[c] for c in m.CLASSES)

return m

# Solve deterministic model to obtain the expectation of the expected value problem (EEV)

model_eev = aircraft_deterministic(demand)

SOLVER.solve(model_eev)

seats_eev = pd.Series({c: model_eev.seats[c]() for c in model_eev.CLASSES})

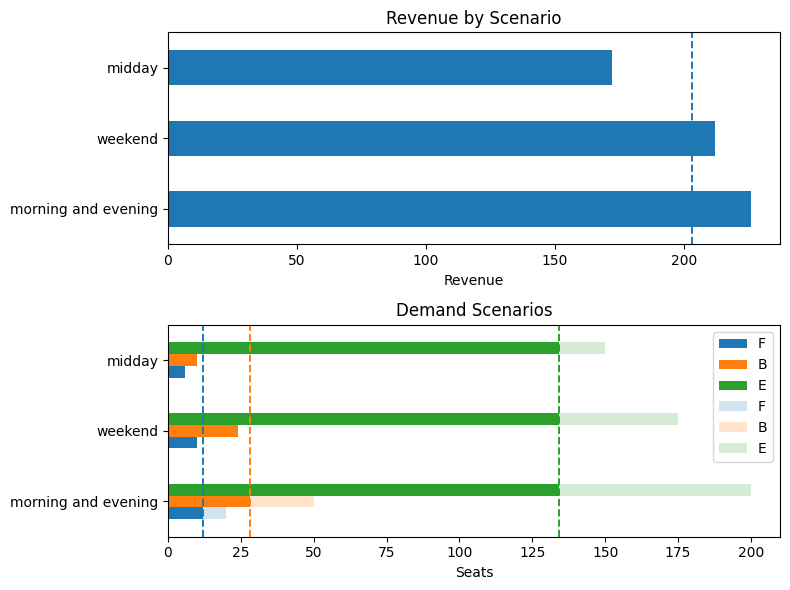

seat_report(seats_eev, demand)

Seat Allocation

| F | B | E | TOTAL | |

|---|---|---|---|---|

| seat allocation | 12.0 | 28.0 | 134.0 | 174.0 |

| economy equivalent seat allocation | 24.0 | 42.0 | 134.0 | 200.0 |

Tickets Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 12.0 | 28.0 | 134.0 |

| weekend | 10.0 | 24.0 | 134.0 |

| midday | 6.0 | 10.0 | 134.0 |

Seats not Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 0.0 | 0.0 | 0.0 |

| weekend | 2.0 | 4.0 | 0.0 |

| midday | 6.0 | 18.0 | 0.0 |

Spillage (Unfulfilled Demand)

| F | B | E | |

|---|---|---|---|

| morning and evening | 8.0 | 22.0 | 66.0 |

| weekend | 0.0 | 0.0 | 41.0 |

| midday | 0.0 | 0.0 | 16.0 |

Expected Revenue (in units of economy ticket price): 203.33

Model 2. Two-stage stochastic optimization and its extensive form#

If we assume demand is not certain, we can formulate a two-stage stochastic optimization problem. The first-stage or here-and-now variables are the \(s_c\)’s, those related to the seat allocations. Due to their dependence on the realized demand \(\boldsymbol{z}\), the variables \(t_c\)’s describing the number of tickets sold, are second-stage or recourse decision variables. The full problem formulation is as follows: the first stage problem is

where \(Q(\boldsymbol{s},\boldsymbol{z})\) is the value of the second-stage problem, defined as

In view of the assumption that there is only a finite number \(N=|S|\) of scenarios for ticket demand, we can write the extensive form of the two-stage stochastic optimization problem above and solve it exactly. To do so, we modify the second-stage variables \(t_{c,s}\) so that they are indexed by both class \(c\) and scenario \(s\). The expectation can thus be replaced with the average revenue over the \(N\) scenarios, that is

where the fraction \(\frac{1}{N}\) appears since we assume that all \(N\) scenarios are equally likely. The first stage constraint remains unchanged, while the second stage constraints are tuplicated for each scenario \(s \in S\), namely

The following cell presents a Pyomo model implementing this model and solving it for the \(N=3\) equiprobable scenarios introduced above.

def aircraft_stochastic(demand):

m = pyo.ConcreteModel("Aircraft seat allocation - Demand scenarios")

m.CLASSES = pyo.Set(initialize=demand.columns)

m.SCENARIOS = pyo.Set(initialize=demand.index)

# first stage variables and constraints

m.seats = pyo.Var(m.CLASSES, domain=pyo.NonNegativeIntegers)

@m.Constraint(m.CLASSES)

def plane_seats(m, c):

return sum(m.seats[c] * seat_factor[c] for c in m.CLASSES) <= capacity

# second stage variable and constraints

m.tickets = pyo.Var(m.CLASSES, m.SCENARIOS, domain=pyo.NonNegativeIntegers)

@m.Constraint(m.CLASSES, m.SCENARIOS)

def demand_limits(m, c, s):

return m.tickets[c, s] <= demand[c][s]

@m.Constraint(m.CLASSES, m.SCENARIOS)

def seat_limits(m, c, s):

return m.tickets[c, s] <= m.seats[c]

# objective

@m.Objective(sense=pyo.maximize)

def revenue(m):

return sum(

m.tickets[c, s] * revenue_factor[c] for c in m.CLASSES for s in m.SCENARIOS

)

return m

# create and solve model for the three scenarios defined above

model_stochastic = aircraft_stochastic(demand)

SOLVER.solve(model_stochastic)

seats_stochastic = pd.Series(

{c: model_stochastic.seats[c]() for c in model_stochastic.CLASSES}

)

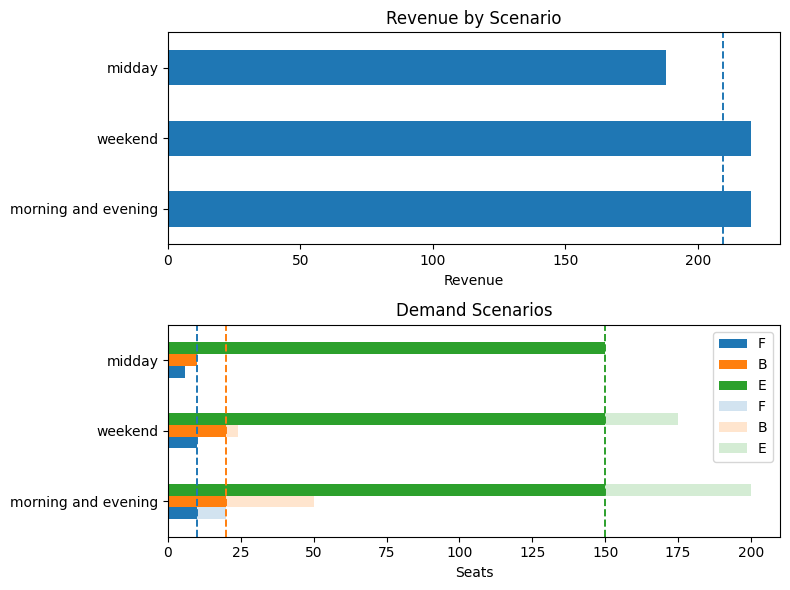

seat_report(seats_stochastic, demand)

Seat Allocation

| F | B | E | TOTAL | |

|---|---|---|---|---|

| seat allocation | 10.0 | 20.0 | 150.0 | 180.0 |

| economy equivalent seat allocation | 20.0 | 30.0 | 150.0 | 200.0 |

Tickets Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 10.0 | 20.0 | 150.0 |

| weekend | 10.0 | 20.0 | 150.0 |

| midday | 6.0 | 10.0 | 150.0 |

Seats not Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 0.0 | 0.0 | 0.0 |

| weekend | 0.0 | 0.0 | 0.0 |

| midday | 4.0 | 10.0 | 0.0 |

Spillage (Unfulfilled Demand)

| F | B | E | |

|---|---|---|---|

| morning and evening | 10.0 | 30.0 | 50.0 |

| weekend | 0.0 | 4.0 | 25.0 |

| midday | 0.0 | 0.0 | 0.0 |

Expected Revenue (in units of economy ticket price): 209.33

Model 3. Adding chance constraints#

The airline wishes a special guarantee for its clients enrolled in its loyalty program. In particular, it wants \(98\%\) probability to cover the demand of first-class seats and \(95\%\) probability to cover the demand of business-class seats (by clients of the loyalty program). First-class passengers are covered if they can purchase a first-class seat. Business-class passengers are covered if they purchase a business-class seat or upgrade to a first-class seat.

Assume the demand of loyalty-program passengers is normally distributed as \(z_F \sim \mathcal N(\mu_F, \sigma_F^2)\) and \(z_B \sim \mathcal N(\mu_B, \sigma_B^2)\) for first-class and business, respectively, where the parameters are given in the table below. For completeness, we also include the parameters for economy-class passengers.

\(\mu_{\cdot}\) |

\(\sigma_{\cdot}\) |

|

|---|---|---|

F |

12 |

4 |

B |

28 |

8 |

E |

175 |

20 |

We further assume that the demands for first-class and business-class seats are independent of each other and of the scenario (time of the week).

Let \(s_F\) be the number of first-class seats and \(s_B\) the number of business seats. The probabilistic constraints are

These are can be written equivalently as linear constraints, specifically

For the second constraint, we use the fact that the sum of the two independent random variables \(z_F\) and \(z_B\) is normally distributed with mean \(\mu_F + \mu_B\) and variance \(\sigma_F^2 + \sigma_B^2\).

We add these equivalent linear counterparts of the two chance constraints to the stochastic optimization model. Rather than writing a function to create a whole new model, we can use the prior function to create and add the two chance constraints using decorators.

# define the mean and standard deviation of the demand for each class

mu = demand.mean()

sigma = {"F": 4, "B": 16, "E": 20}

def aircraft_cc(demand, QoSF=0.98, QoSFB=0.95):

# create two-stage stochastic model as before

m = aircraft_stochastic(demand)

# add equivalent counterparts of the two chance constraints to the first stage problem

# the coefficients related the inverse CDF of the standard normal are computed using the norm.ppf function

@m.Constraint()

def first_class(m):

return (m.seats["F"] - mu["F"]) >= norm.ppf(QoSF) * sigma["F"]

@m.Constraint()

def business_class(m):

return m.seats["F"] + m.seats["B"] - (mu["F"] + mu["B"]) >= norm.ppf(

QoSFB

) * np.sqrt(sigma["F"] ** 2 + sigma["B"] ** 2)

return m

# create and solve model

model_cc = aircraft_cc(demand)

SOLVER.solve(model_cc)

seats_cc = pd.Series({c: model_cc.seats[c]() for c in model_cc.CLASSES})

seat_report(seats_cc, demand)

Seat Allocation

| F | B | E | TOTAL | |

|---|---|---|---|---|

| seat allocation | 21.0 | 47.0 | 87.0 | 155.0 |

| economy equivalent seat allocation | 42.0 | 70.5 | 87.0 | 199.5 |

Tickets Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 20.0 | 47.0 | 87.0 |

| weekend | 10.0 | 24.0 | 87.0 |

| midday | 6.0 | 10.0 | 87.0 |

Seats not Sold

| F | B | E | |

|---|---|---|---|

| morning and evening | 1.0 | 0.0 | 0.0 |

| weekend | 11.0 | 23.0 | 0.0 |

| midday | 15.0 | 37.0 | 0.0 |

Spillage (Unfulfilled Demand)

| F | B | E | |

|---|---|---|---|

| morning and evening | 0.0 | 3.0 | 113.0 |

| weekend | 0.0 | 0.0 | 88.0 |

| midday | 0.0 | 0.0 | 63.0 |

Expected Revenue (in units of economy ticket price): 177.00

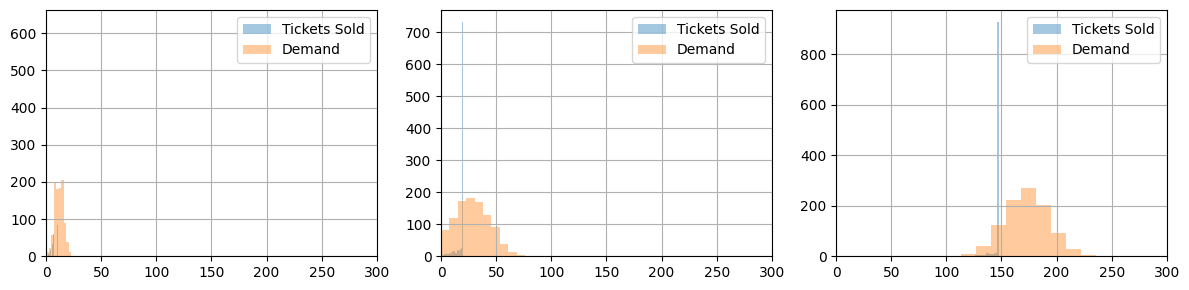

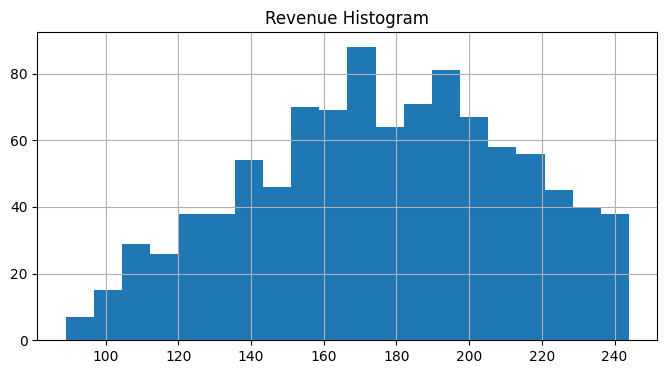

Model 4. Solving the case of continuous demand distributions using the SAA method#

Let us now move past the simplifying assumption that there are only three equally likely scenarios and consider the case where the demand is described by a random vector \((z_F, z_B, z_E)\), where \(z_c\) is the demand for seats of class \(c\in C\). The demand for class \(c\) is assumed to be independent and normally distributed with mean \(\mu_c\) and variance \(\sigma_c^2\) as reported in the following table

\(\mu\) |

\(\sigma\) |

|

|---|---|---|

F |

12 |

4 |

B |

28 |

8 |

E |

175 |

20 |

Note that we model the demand for each class using a continuous random variable, which is a simplification of the real world, where the ticket demand is always a discrete nonnegative number. Therefore, we round down all the obtained random numbers.

However, now that the number of scenarios is not finite anymore, we cannot solve the problem exactly. Instead, we can use the SAA method to approximate the expected value appearing in the objective function. The first step of the SAA is to generate a collection of \(N\) scenarios \((z_{F,s}, z_{B,s}, z_{E,s})\) for \(s=1,\ldots,N\). We can do this by sampling from the normal distributions with the given means and variances.

For sake of generality, we create a script to generate scenarios in which the three demands have a general correlation structure captured by a correlation matrix \(\bm{\rho}\).

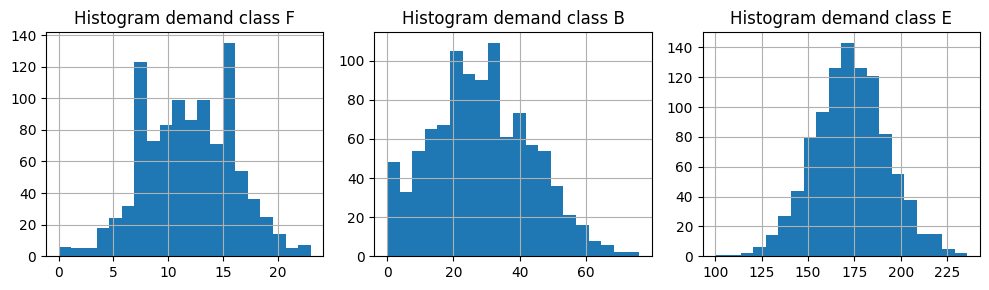

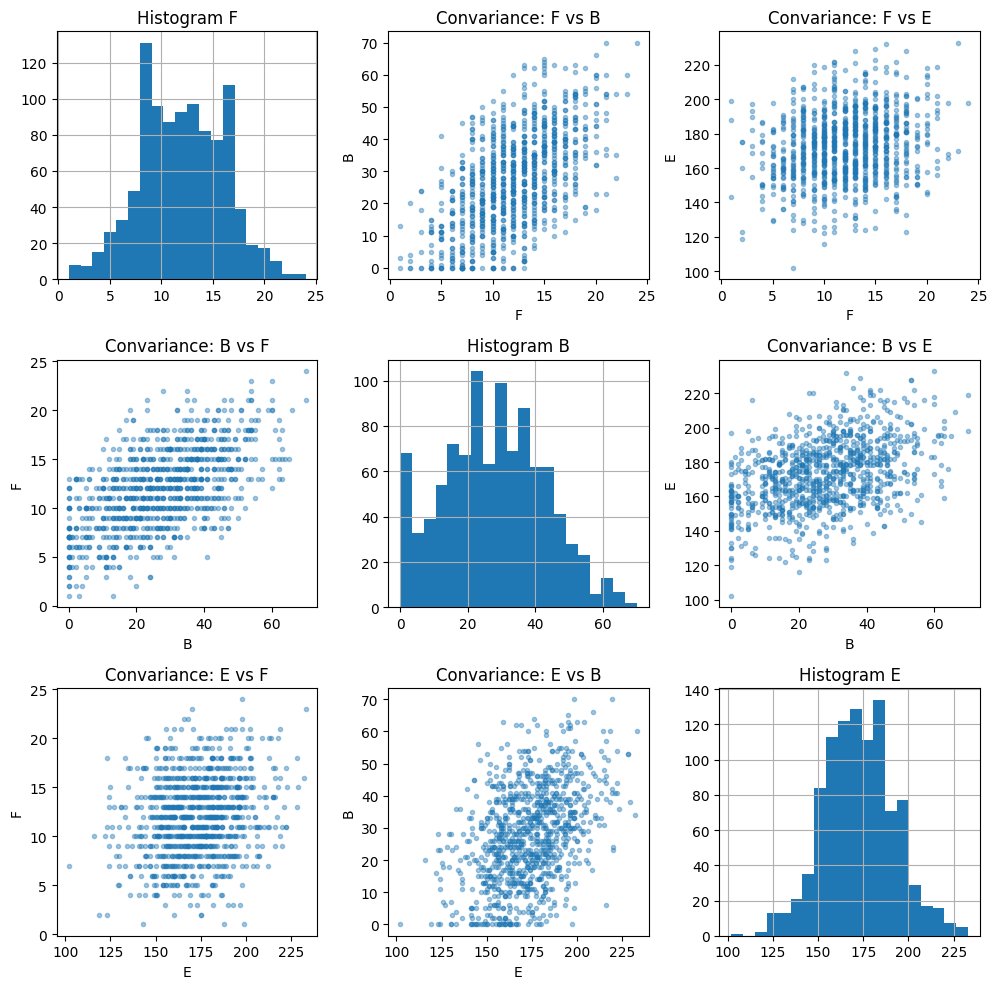

Model 5. Adding correlations between different demand types#

Now assume the ticket demand for the three categories is captured by a \(3\)-dimensional multivariate normal distribution mean \(\mu=(\mu_F, \mu_B, \mu_E)\), variances \((\sigma_F^2, \sigma_B^2, \sigma_E^2)\) and a symmetric correlation matrix

The covariance matrix is given by \(\Sigma = \text{diag}(\sigma)\ P\ \text{diag}(\sigma)\) or

We assume \(\rho_{FB} = 0.6\), \(\rho_{BE} = 0.4\) and \(\rho_{FE} = 0.2\).

We now sample \(N=1000\) scenarios from this multivariate correlated normal distribution and use the SAA method to approximate the solution of the two-stage stochastic optimization problem.

# sample size

N = 1000

# define the mean mu and standard deviation sigma of the demand for each class

mu = demand.mean()

sigma = {"F": 4, "B": 16, "E": 20}

classes = demand.columns

display(pd.DataFrame({"mu": mu, "sigma": sigma}))

# correlation matrix

P = np.array([[1, 0.6, 0.2], [0.6, 1, 0.4], [0.2, 0.4, 1]])

# build covariance matrix from covariances and correlations

s = np.array(list(sigma.values()))

S = np.diag(s) @ P @ np.diag(s)

# generate N samples, round each demand entry to nearest integer, and correct non-negative values

seed = 0

rng = np.random.default_rng(seed)

samples = rng.multivariate_normal(list(mu), S, N).round()

demand_saa = pd.DataFrame(samples, columns=classes)

demand_saa[demand_saa < 0] = 0

df = pd.DataFrame(mu, columns=["mu"])

df["sample means"] = demand_saa.mean()

display(df)

df = pd.DataFrame(pd.Series(sigma), columns=["sigma"])

df["sample std dev"] = demand_saa.std()

display(df)

print("\nModel Covariance")

df = pd.DataFrame(S, index=classes, columns=classes)

display(df)

print("\nSample Covariance")

display(pd.DataFrame(demand_saa.cov()))

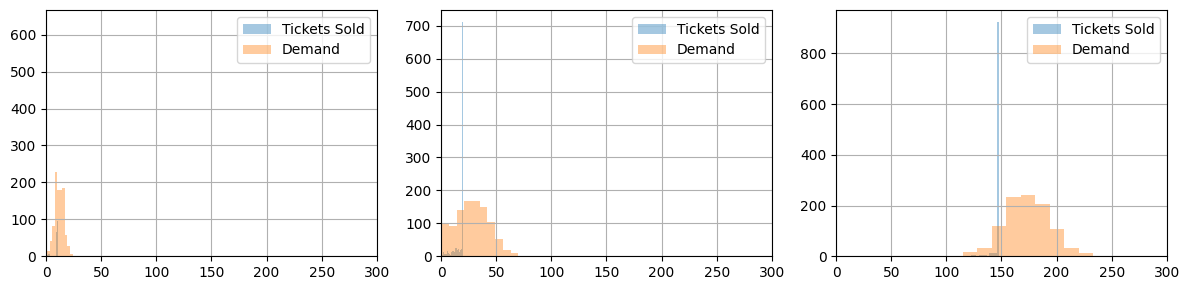

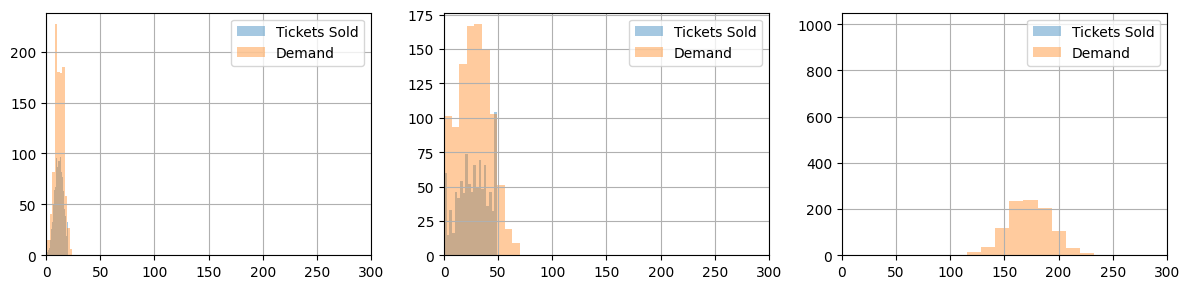

fig, ax = plt.subplots(3, 3, figsize=(10, 10))

for i, ci in enumerate(classes):

for j, cj in enumerate(classes):

if i == j:

demand_saa[ci].hist(ax=ax[i, i], bins=20)

ax[i, i].set_title(f"Histogram {ci}")

else:

ax[i, j].plot(demand_saa[ci], demand_saa[cj], ".", alpha=0.4)

ax[i, j].set_xlabel(ci)

ax[i, j].set_ylabel(cj)

ax[i, j].set_title(f"Convariance: {ci} vs {cj}")

fig.tight_layout()

| mu | sigma | |

|---|---|---|

| F | 12.0 | 4 |

| B | 28.0 | 16 |

| E | 175.0 | 20 |

| mu | sample means | |

|---|---|---|

| F | 12.0 | 11.999 |

| B | 28.0 | 27.458 |

| E | 175.0 | 172.901 |

| sigma | sample std dev | |

|---|---|---|

| F | 4 | 4.044918 |

| B | 16 | 14.973257 |

| E | 20 | 19.839072 |

Model Covariance

| F | B | E | |

|---|---|---|---|

| F | 16.0 | 38.4 | 16.0 |

| B | 38.4 | 256.0 | 128.0 |

| E | 16.0 | 128.0 | 400.0 |

Sample Covariance

| F | B | E | |

|---|---|---|---|

| F | 16.361360 | 35.366825 | 16.679581 |

| B | 35.366825 | 224.198434 | 123.274617 |

| E | 16.679581 | 123.274617 | 393.588788 |

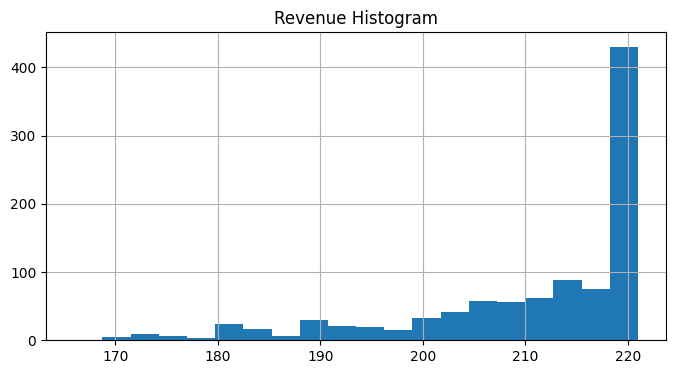

model_saa = aircraft_stochastic(demand_saa)

SOLVER.solve(model_saa)

seats_saa = pd.Series({c: model_saa.seats[c]() for c in model_saa.CLASSES})

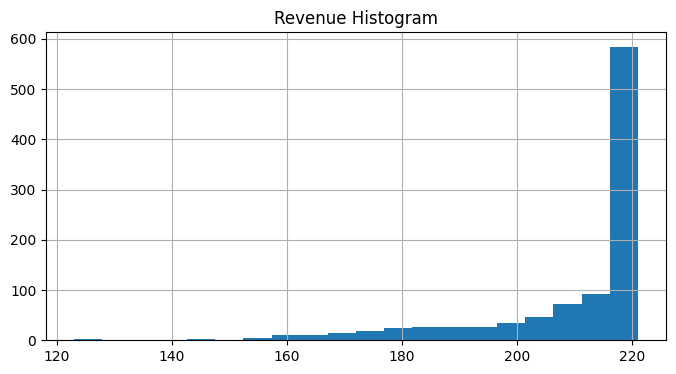

seat_report_saa(seats_saa, demand_saa)

Seat Allocation

| F | B | E | TOTAL | |

|---|---|---|---|---|

| seat allocation | 11.0 | 20.0 | 148.0 | 179.0 |

| economy equivalent seat allocation | 22.0 | 30.0 | 148.0 | 200.0 |

Mean Tickets Sold

F 9.825

B 16.955

E 147.044

dtype: float64

Mean Seats not Sold

F 1.175

B 3.045

E 0.956

dtype: float64

Mean Spillage (Unfulfilled Demand)

F 2.174

B 10.503

E 25.857

dtype: float64

Expected Revenue (in units of economy ticket price): 210.43