Extra material: Refinery production and shadow pricing with CVXPY#

This is a simple linear optimization problem in six variables, but with four equality constraints it allows for a graphical explanation of some unusually large shadow prices for manufacturing capacity. The notebook presents also contrasts Pyomo with CVXPY modeling.

Preamble: Install Pyomo and a solver#

The following cell sets and verifies a global SOLVER for the notebook. If run on Google Colab, the cell installs Pyomo and the HiGHS solver, while, if run elsewhere, it assumes Pyomo and HiGHS have been previously installed. It then sets to use HiGHS as solver via the appsi module and a test is performed to verify that it is available. The solver interface is stored in a global object SOLVER for later use.

import sys

if 'google.colab' in sys.modules:

%pip install pyomo >/dev/null 2>/dev/null

%pip install highspy >/dev/null 2>/dev/null

solver = 'appsi_highs'

import pyomo.environ as pyo

SOLVER = pyo.SolverFactory(solver)

assert SOLVER.available(), f"Solver {solver} is not available."

%pip install -q cvxpy

This example derived from Example 19.3 from Seborg, Edgar, Mellichamp, and Doyle.

Seborg, Dale E., Thomas F. Edgar, Duncan A. Mellichamp, and Francis J. Doyle III. Process dynamics and control. John Wiley & Sons, 2016.

The changes include updating prices, new solutions using optimization modeling languages, adding constraints, and adjusting parameter values to demonstrate the significance of duals and their interpretation as shadow prices.

Problem data#

import numpy as np

import cvxpy as cp

import pandas as pd

products = pd.DataFrame(

{

"gasoline": {"capacity": 24000, "price": 108},

"kerosine": {"capacity": 2000, "price": 72},

"fuel oil": {"capacity": 6000, "price": 63},

"residual": {"capacity": 2500, "price": 30},

}

).T

crudes = pd.DataFrame(

{

"crude 1": {"available": 28000, "price": 72, "process cost": 1.5},

"crude 2": {"available": 15000, "price": 45, "process cost": 3},

}

).T

# note: volumetric yields may not add to 100%

yields = pd.DataFrame(

{

"crude 1": {"gasoline": 80, "kerosine": 5, "fuel oil": 10, "residual": 5},

"crude 2": {"gasoline": 44, "kerosine": 10, "fuel oil": 36, "residual": 10},

}

).T

display(products)

display(crudes)

display(yields)

| capacity | price | |

|---|---|---|

| gasoline | 24000 | 108 |

| kerosine | 2000 | 72 |

| fuel oil | 6000 | 63 |

| residual | 2500 | 30 |

| available | price | process cost | |

|---|---|---|---|

| crude 1 | 28000.0 | 72.0 | 1.5 |

| crude 2 | 15000.0 | 45.0 | 3.0 |

| gasoline | kerosine | fuel oil | residual | |

|---|---|---|---|---|

| crude 1 | 80 | 5 | 10 | 5 |

| crude 2 | 44 | 10 | 36 | 10 |

Pyomo Model#

m = pyo.ConcreteModel()

m.CRUDES = pyo.Set(initialize=crudes.index)

m.PRODUCTS = pyo.Set(initialize=products.index)

# decision variables

m.x = pyo.Var(m.CRUDES, domain=pyo.NonNegativeReals)

m.y = pyo.Var(m.PRODUCTS, domain=pyo.NonNegativeReals)

# objective

@m.Expression()

def revenue(m):

return sum(products.loc[p, "price"] * m.y[p] for p in m.PRODUCTS)

@m.Expression()

def feed_cost(m):

return sum(crudes.loc[c, "price"] * m.x[c] for c in m.CRUDES)

@m.Expression()

def process_cost(m):

return sum(crudes.loc[c, "process cost"] * m.x[c] for c in m.CRUDES)

@m.Objective(sense=pyo.maximize)

def profit(m):

return m.revenue - m.feed_cost - m.process_cost

# constraints

@m.Constraint(m.PRODUCTS)

def balances(m, p):

return m.y[p] == sum(yields.loc[c, p] * m.x[c] for c in m.CRUDES) / 100

@m.Constraint(m.CRUDES)

def feeds(m, c):

return m.x[c] <= crudes.loc[c, "available"]

@m.Constraint(m.PRODUCTS)

def capacity(m, p):

return m.y[p] <= products.loc[p, "capacity"]

SOLVER.solve(m)

print(round(m.profit(), 3))

860275.832

CVXPY Model#

The CVXPY library for disciplined convex optimization is tightly integrated with numpy, the standard Python library for the numerical linear algebra. For example, where Pyomo uses explicit indexing in constraints, summations, and other objects, CVXPY uses the implicit indexing implied when doing matrix and vector operations.

Another sharp contrast with Pyomo is that CXVPY has no specific object to describe a set,or to define a objects variables or other modeling objects over arbitrary sets. CVXPY instead uses the zero-based indexing familiar to Python users.

The following cell demonstrates these differences by presenting a CVXPY model for the small refinery example.

# decision variables

x = cp.Variable(len(crudes.index), pos=True, name="crudes")

y = cp.Variable(len(products.index), pos=True, name="products")

# objective

revenue = products["price"].to_numpy().T @ y

feed_cost = crudes["price"].to_numpy().T @ x

process_cost = crudes["process cost"].to_numpy().T @ x

profit = revenue - feed_cost - process_cost

objective = cp.Maximize(profit)

# constraints

balances = y == yields.to_numpy().T @ x / 100

feeds = x <= crudes["available"].to_numpy()

capacity = y <= products["capacity"].to_numpy()

constraints = [balances, feeds, capacity]

# solution

problem = cp.Problem(objective, constraints)

problem.solve()

860275.8620663473

Crude oil feed results#

results_crudes = crudes

results_crudes["consumption"] = x.value

results_crudes["shadow price"] = feeds.dual_value

display(results_crudes.round(1))

| available | price | process cost | consumption | shadow price | |

|---|---|---|---|---|---|

| crude 1 | 28000.0 | 72.0 | 1.5 | 26206.9 | 0.0 |

| crude 2 | 15000.0 | 45.0 | 3.0 | 6896.6 | 0.0 |

Refinery production results#

results_products = products

results_products["production"] = y.value

results_products["unused capacity"] = products["capacity"] - y.value

results_products["shadow price"] = capacity.dual_value

display(results_products.round(1))

| capacity | price | production | unused capacity | shadow price | |

|---|---|---|---|---|---|

| gasoline | 24000 | 108 | 24000.0 | 0.0 | 14.0 |

| kerosine | 2000 | 72 | 2000.0 | 0.0 | 262.6 |

| fuel oil | 6000 | 63 | 5103.4 | 896.6 | 0.0 |

| residual | 2500 | 30 | 2000.0 | 500.0 | 0.0 |

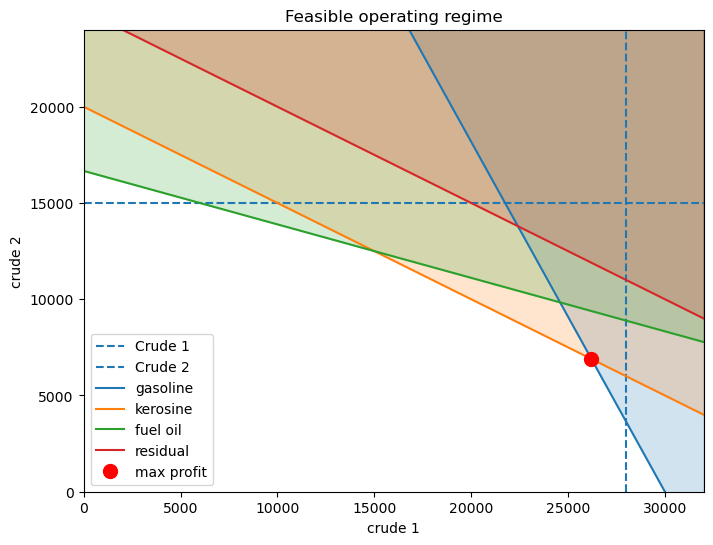

Why is the shadow price of kerosine so high?#

import matplotlib.pyplot as plt

import numpy as np

fig, ax = plt.subplots(figsize=(8, 6))

ylim = 24000

xlim = 32000

ax.axvline(crudes["available"][0], linestyle="--", label="Crude 1")

ax.axhline(crudes["available"][1], linestyle="--", label="Crude 2")

xplot = np.linspace(0, xlim)

for product in products.index:

b = 100 * products.loc[product, "capacity"] / yields[product][1]

m = -yields[product][0] / yields[product][1]

line = ax.plot(xplot, m * xplot + b, label=product)

ax.fill_between(xplot, m * xplot + b, 30000, color=line[0].get_color(), alpha=0.2)

ax.plot(x.value[0], x.value[1], "ro", ms=10, label="max profit")

ax.set_title("Feasible operating regime")

ax.set_xlabel(crudes.index[0])

ax.set_ylabel(crudes.index[1])

ax.legend()

ax.set_xlim(0, xlim)

ax.set_ylim(0, ylim)

(0.0, 24000.0)

Suggested Exercises#

Suppose the refinery makes a substantial investment to double kerosene production in order to increase profits. What becomes the limiting constraint?

How do prices of crude oil and refinery products change the location of the optimum operating point?

A refinery is a financial asset for the conversion of commodity crude oils into commodity hydrocarbons. What economic value can be assigned to owning the option to convert crude oils into other commodities?