4.5 Cryptocurrency arbitrage search#

Installations and Imports#

Preamble: Install Pyomo and a solver#

The following cell sets and verifies a global SOLVER for the notebook. If run on Google Colab, the cell installs Pyomo and the HiGHS solver, while, if run elsewhere, it assumes Pyomo and HiGHS have been previously installed. It then sets to use HiGHS as solver via the appsi module and a test is performed to verify that it is available. The solver interface is stored in a global object SOLVER for later use.

import sys

if 'google.colab' in sys.modules:

%pip install pyomo >/dev/null 2>/dev/null

%pip install highspy >/dev/null 2>/dev/null

solver = 'appsi_highs'

import pyomo.environ as pyo

SOLVER = pyo.SolverFactory(solver)

assert SOLVER.available(), f"Solver {solver} is not available."

Problem description#

Cryptocurrency exchanges are web services that enable the purchase, sale, and exchange of cryptocurrencies. These exchanges provide liquidity for owners and establish the relative value of these currencies. Joining an exchange enables a user to maintain multiple currencies in a digital wallet, buy and sell currencies, and use cryptocurrencies for financial transactions.

In this notebook, we explore the efficiency of cryptocurrency exchanges by testing for arbitrage opportunities. An arbitrage exists if a customer can realize a net profit through a sequence of risk-free trades. The efficient market hypothesis assumes arbitrage opportunities are quickly identified and exploited by investors. As a result of their trading, prices reach a new equilibrium so that any arbitrage opportunities would be small and fleeting in an efficient market. The question here is whether it is possible, with real-time data and rapid execution, for a trader to profit from these fleeting arbitrage opportunities.

Additional libraries needed: NetworkX and CCXT#

This notebook uses two additional libraries: NetworkX and CCXT.

NetworkX is a Python library for the creation, manipulation, and study of the structure, dynamics, and functions of complex networks, which is installed by deafult on Google Colab.

CCXT is an open-source library for connecting to cryptocurrency exchanges. The CCXT library is not installed by default in Google Colab, so it must be installed with the following command.

%pip install ccxt

%pip install ccxt

We import all the libraries we need for this notebook in the following cell.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import networkx as nx

import ccxt

import glob

Available cryptocurrency exchanges#

Here we use the ccxt library and list current exchanges supported by ccxt.

print("Available exchanges:\n")

for i, exchange in enumerate(ccxt.exchanges):

print(f"{i+1:3d}) {exchange.ljust(20)}", end="" if (i + 1) % 4 else "\n")

Available exchanges:

1) ace 2) alpaca 3) ascendex 4) bequant

5) bigone 6) binance 7) binancecoinm 8) binanceus

9) binanceusdm 10) bit2c 11) bitbank 12) bitbay

13) bitbns 14) bitcoincom 15) bitfinex 16) bitfinex2

17) bitflyer 18) bitforex 19) bitget 20) bithumb

21) bitmart 22) bitmex 23) bitopro 24) bitpanda

25) bitrue 26) bitso 27) bitstamp 28) bitstamp1

29) bittrex 30) bitvavo 31) bkex 32) bl3p

33) blockchaincom 34) btcalpha 35) btcbox 36) btcmarkets

37) btctradeua 38) btcturk 39) bybit 40) cex

41) coinbase 42) coinbaseprime 43) coinbasepro 44) coincheck

45) coinex 46) coinfalcon 47) coinmate 48) coinone

49) coinsph 50) coinspot 51) cryptocom 52) currencycom

53) delta 54) deribit 55) digifinex 56) exmo

57) fmfwio 58) gate 59) gateio 60) gemini

61) hitbtc 62) hitbtc3 63) hollaex 64) huobi

65) huobijp 66) huobipro 67) idex 68) independentreserve

69) indodax 70) kraken 71) krakenfutures 72) kucoin

73) kucoinfutures 74) kuna 75) latoken 76) lbank

77) lbank2 78) luno 79) lykke 80) mercado

81) mexc 82) mexc3 83) ndax 84) novadax

85) oceanex 86) okcoin 87) okex 88) okex5

89) okx 90) paymium 91) phemex 92) poloniex

93) poloniexfutures 94) probit 95) tidex 96) timex

97) tokocrypto 98) upbit 99) wavesexchange 100) wazirx

101) whitebit 102) woo 103) yobit 104) zaif

105) zonda

Representing an exchange as a directed graph#

First, we need some terminology. Trading between two specific currencies is called a market, with each exchange hosting multiple markets. ccxt labels each market with a symbol common across exchanges. The market symbol is an upper-case string with abbreviations for a pair of traded currencies separated by a slash (\(/\)). The first abbreviation is the base currency, the second is the quote currency. Prices for the base currency are denominated in units of the quote currency. As an example, \(ETH/BTC\) refers to a market for the base currency Ethereum (ETH) quoted in units of the Bitcoin (BTC). The same market symbol can refer to an offer to sell the base currency (a ‘bid’) or to an offer to sell the base currency (an ‘ask’). For example, \(x\) ETH/BTC means you can buy \(x\) units of BTC with one unit of ETH.

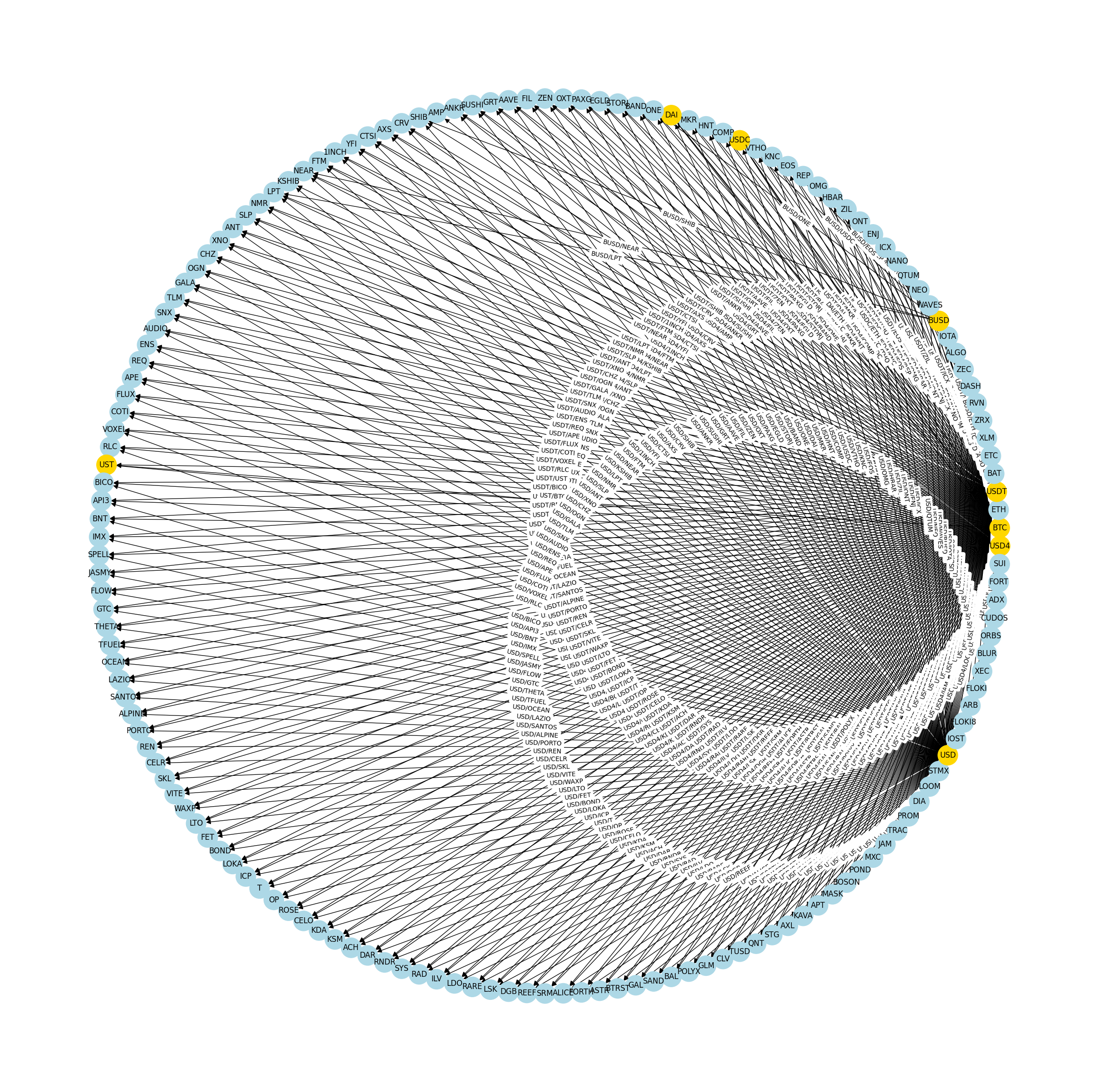

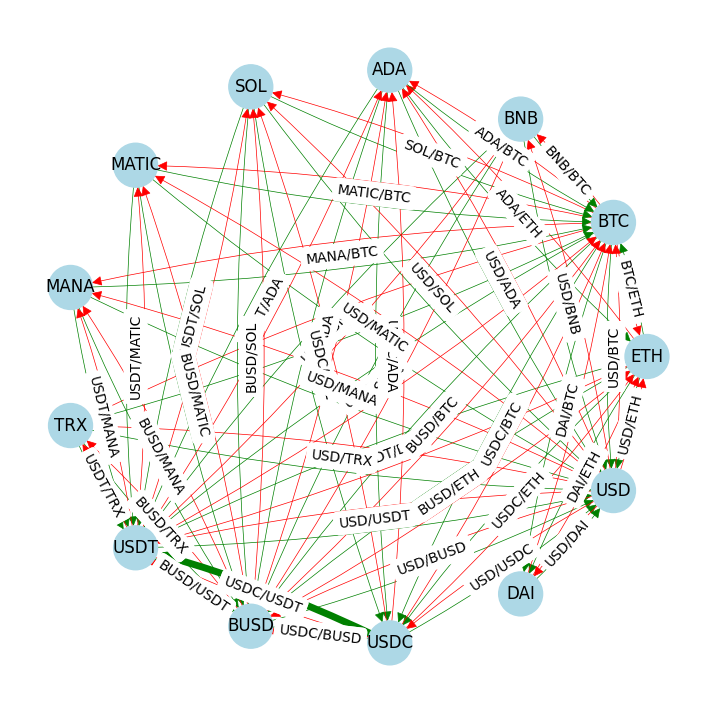

An exchange can be represented by a directed graph constructed from the market symbols available on that exchange. In such a graph currencies correspond to nodes on the directed graph. Market symbols correspond to edges in the directed graph, with the source indicating the quote currency and the destination indicating the base currency. The following code develops such a sample graph.

# create an exchange object

exchange = ccxt.binanceus()

def get_exchange_dg(exchange, minimum_in_degree=1):

markets = exchange.load_markets()

symbols = markets.keys()

# create an edge for all market symbols

dg = nx.DiGraph()

for base, quote in [symbol.split("/") for symbol in symbols]:

dg.add_edge(quote, base, color="k", width=1)

# remove base currencies with in_degree less than minimum_in_degree

remove_nodes = [

node

for node in dg.nodes

if dg.out_degree(node) == 0 and dg.in_degree(node) < minimum_in_degree

]

for node in reversed(list(nx.topological_sort(dg))):

if node in remove_nodes:

dg.remove_node(node)

else:

break

# color quote currencies in gold

for node in dg.nodes():

dg.nodes[node]["color"] = "gold" if dg.out_degree(node) > 0 else "lightblue"

return dg

def draw_dg(dg, rad=0.0):

n_nodes = len(dg.nodes)

size = int(2.5 * np.sqrt(n_nodes))

fig = plt.figure(figsize=(size, size))

pos = nx.circular_layout(dg)

nx.draw_networkx(

dg,

pos,

with_labels=True,

node_color=[dg.nodes[node]["color"] for node in dg.nodes()],

edge_color=[dg.edges[u, v]["color"] for u, v in dg.edges],

width=[dg.edges[u, v]["width"] for u, v in dg.edges],

node_size=1000,

font_size=12,

arrowsize=15,

connectionstyle=f"arc3, rad={rad}",

)

nx.draw_networkx_edge_labels(

dg, pos, edge_labels={(src, dst): f"{src}/{dst}" for src, dst in dg.edges()}

)

plt.axis("off")

return plt.gca()

minimum_in_degree = 10

exchange_dg = get_exchange_dg(exchange, minimum_in_degree)

ax = draw_dg(exchange_dg, 0.01)

print(

exchange.name

+ f" - Network obtained filtering for minimum indegree (Base Currencies) = {minimum_in_degree}"

)

print(f"Number of nodes = {len(exchange_dg.nodes()):3d}")

print(f"Number of edges = {len(exchange_dg.edges()):3d}")

Binance US - Network obtained filtering for minimum indegree (Base Currencies) = 10

Number of nodes = 155

Number of edges = 449

Exchange order book#

The order book for a currency exchange is the real-time inventory of trading orders.

A bid is an offer to buy up to a specified amount of the base currency at the price not exceeding the ‘bid price’ in the quote currency. An ask is an offer to sell up to a specified amount of the base currency at a price no less than a value specified given in the quote currency.

The exchange attempts to match the bid to ask order at a price less than or equal to the bid price. If a transaction occurs, the buyer will receive an amount of base currency less than or equal to the bid volume and the ask volume, at a price less than or equal to the bid price and no less than the specified value.

The order book for currency exchange is the real-time inventory of orders. The exchange order book maintains a list of all active orders for symbols traded on the exchange. Incoming bids above the lowest ask or incoming asks below the highest bid will be immediately matched and transactions executed following the rules of the exchange.

The following cell reads and displays a previously saved order book. Cells at the end of this notebook demonstrate how to retrieve an order book from an exchange and save it as a Pandas DataFrame.

filename = "Binance_US_orderbook_saved.csv"

if "google.colab" in sys.modules:

order_book = pd.read_csv(

"https://raw.githubusercontent.com/mobook/MO-book/main/notebooks/04/data/"

+ filename,

index_col=0,

)

else:

order_book = pd.read_csv("data/" + filename, index_col=0)

display(order_book)

| symbol | timestamp | base | quote | bid_price | bid_volume | ask_price | ask_volume | |

|---|---|---|---|---|---|---|---|---|

| 0 | ETH/BTC | 2023-03-02 15:36:06.529 | ETH | BTC | 0.069735 | 0.012000 | 0.069759 | 0.050000 |

| 1 | BNB/BTC | 2023-03-02 15:36:06.583 | BNB | BTC | 0.012743 | 0.050000 | 0.012755 | 3.000000 |

| 2 | ADA/BTC | 2023-03-02 15:36:06.637 | ADA | BTC | 0.000015 | 2.000000 | 0.000015 | 2168.000000 |

| 3 | SOL/BTC | 2023-03-02 15:36:06.690 | SOL | BTC | 0.000935 | 1.420000 | 0.000936 | 15.120000 |

| 4 | MATIC/BTC | 2023-03-02 15:36:06.750 | MATIC | BTC | 0.000052 | 26.200000 | 0.000052 | 150.200000 |

| 5 | MANA/BTC | 2023-03-02 15:36:06.848 | MANA | BTC | 0.000027 | 831.000000 | 0.000027 | 1409.000000 |

| 6 | TRX/BTC | 2023-03-02 15:36:06.905 | TRX | BTC | 0.000003 | 4.000000 | 0.000003 | 25352.000000 |

| 7 | ADA/ETH | 2023-03-02 15:36:06.960 | ADA | ETH | 0.000214 | 994.900000 | 0.000214 | 891.600000 |

| 8 | BTC/USDT | 2023-03-02 15:36:07.012 | BTC | USDT | 23373.920000 | 0.118619 | 23376.000000 | 0.045275 |

| 9 | ETH/USDT | 2023-03-02 15:36:07.065 | ETH | USDT | 1630.200000 | 0.950000 | 1630.770000 | 0.500000 |

| 10 | BNB/USDT | 2023-03-02 15:36:07.118 | BNB | USDT | 297.857700 | 0.800000 | 297.891900 | 0.800000 |

| 11 | ADA/USDT | 2023-03-02 15:36:07.172 | ADA | USDT | 0.348630 | 1100.000000 | 0.348750 | 511.200000 |

| 12 | BUSD/USDT | 2023-03-02 15:36:07.226 | BUSD | USDT | 0.999500 | 293433.930000 | 0.999600 | 317175.730000 |

| 13 | SOL/USDT | 2023-03-02 15:36:07.288 | SOL | USDT | 21.857000 | 22.870000 | 21.863500 | 23.000000 |

| 14 | USDC/USDT | 2023-03-02 15:36:07.342 | USDC | USDT | 1.000100 | 307657.000000 | 1.000200 | 299181.000000 |

| 15 | MATIC/USDT | 2023-03-02 15:36:07.394 | MATIC | USDT | 1.203000 | 1664.600000 | 1.205000 | 5405.600000 |

| 16 | MANA/USDT | 2023-03-02 15:36:07.447 | MANA | USDT | 0.631000 | 157.000000 | 0.632200 | 571.000000 |

| 17 | TRX/USDT | 2023-03-02 15:36:07.501 | TRX | USDT | 0.069280 | 10824.900000 | 0.069330 | 10818.600000 |

| 18 | BTC/BUSD | 2023-03-02 15:36:07.612 | BTC | BUSD | 23371.440000 | 0.021500 | 23376.830000 | 0.021500 |

| 19 | BNB/BUSD | 2023-03-02 15:36:07.665 | BNB | BUSD | 297.763000 | 1.670000 | 297.952500 | 1.340000 |

| 20 | ETH/BUSD | 2023-03-02 15:36:07.719 | ETH | BUSD | 1630.210000 | 0.510000 | 1630.760000 | 0.255000 |

| 21 | MATIC/BUSD | 2023-03-02 15:36:07.772 | MATIC | BUSD | 1.203410 | 623.100000 | 1.204540 | 415.000000 |

| 22 | USDC/BUSD | 2023-03-02 15:36:07.893 | USDC | BUSD | 0.999900 | 329027.800000 | 1.000000 | 279879.620000 |

| 23 | MANA/BUSD | 2023-03-02 15:36:07.950 | MANA | BUSD | 0.630700 | 343.000000 | 0.632100 | 3054.000000 |

| 24 | ADA/BUSD | 2023-03-02 15:36:08.003 | ADA | BUSD | 0.348000 | 6582.900000 | 0.349000 | 997.000000 |

| 25 | SOL/BUSD | 2023-03-02 15:36:08.056 | SOL | BUSD | 21.830000 | 1.390000 | 21.900000 | 181.090000 |

| 26 | TRX/BUSD | 2023-03-02 15:36:08.114 | TRX | BUSD | 0.069290 | 10823.900000 | 0.069390 | 25220.400000 |

| 27 | BTC/USDC | 2023-03-02 15:36:08.170 | BTC | USDC | 23371.660000 | 0.020000 | 23376.990000 | 0.051000 |

| 28 | ETH/USDC | 2023-03-02 15:36:08.228 | ETH | USDC | 1630.160000 | 0.100000 | 1630.810000 | 0.215000 |

| 29 | SOL/USDC | 2023-03-02 15:36:08.298 | SOL | USDC | 21.830000 | 343.520000 | 21.880000 | 201.080000 |

| 30 | ADA/USDC | 2023-03-02 15:36:08.368 | ADA | USDC | 0.348200 | 8615.400000 | 0.349400 | 2433.100000 |

| 31 | BTC/DAI | 2023-03-02 15:36:08.433 | BTC | DAI | 23366.440000 | 0.049540 | 23394.360000 | 0.049500 |

| 32 | ETH/DAI | 2023-03-02 15:36:08.485 | ETH | DAI | 1629.890000 | 0.497400 | 1631.810000 | 1.490000 |

| 33 | BTC/USD | 2023-03-02 15:36:08.623 | BTC | USD | 23373.010000 | 0.007463 | 23376.720000 | 0.048805 |

| 34 | ETH/USD | 2023-03-02 15:36:08.675 | ETH | USD | 1630.490000 | 2.564550 | 1630.740000 | 0.580700 |

| 35 | USDT/USD | 2023-03-02 15:36:08.730 | USDT | USD | 1.000000 | 10407.870000 | 1.000100 | 954839.680000 |

| 36 | BNB/USD | 2023-03-02 15:36:08.782 | BNB | USD | 297.900200 | 2.100000 | 297.952500 | 1.342000 |

| 37 | ADA/USD | 2023-03-02 15:36:08.835 | ADA | USD | 0.348800 | 1500.000000 | 0.348900 | 3000.000000 |

| 38 | BUSD/USD | 2023-03-02 15:36:08.942 | BUSD | USD | 0.999500 | 79157.800000 | 0.999900 | 795593.480000 |

| 39 | MATIC/USD | 2023-03-02 15:36:08.998 | MATIC | USD | 1.204000 | 937.600000 | 1.204500 | 937.500000 |

| 40 | USDC/USD | 2023-03-02 15:36:09.051 | USDC | USD | 0.999900 | 5050.300000 | 1.000000 | 517682.170000 |

| 41 | MANA/USD | 2023-03-02 15:36:09.102 | MANA | USD | 0.631000 | 372.340000 | 0.631600 | 572.340000 |

| 42 | DAI/USD | 2023-03-02 15:36:09.155 | DAI | USD | 0.999100 | 4534.660000 | 1.000100 | 7591.820000 |

| 43 | SOL/USD | 2023-03-02 15:36:09.217 | SOL | USD | 21.858100 | 55.730000 | 21.865900 | 18.290000 |

| 44 | TRX/USD | 2023-03-02 15:36:09.270 | TRX | USD | 0.069200 | 225602.200000 | 0.069400 | 224245.500000 |

Modelling the arbitrage search problem as a graph#

Our goal will be to find arbitrage opportunities, i.e., the possibility to start from a given currency and, through a sequence of executed trades, arrive back at the same currency with a higher balance than at the beginning. We will model this problem as a network one.

A bid appearing in the order book for the market symbol \(b/q\) is an order from a prospective counter party to purchase an amount of the base currency \(b\) at a bid price given in a quote currency \(q\). For a currency trader, a bid in the order book is an opportunity to convert the base currency \(b\) into the quote currency \(q\).

The order book can be represented as a directed graph where the nodes correspond to individual currencies. A directed edge \(b\rightarrow q\) from node \(b\) to node \(q\) describes an opportunity for us to convert currency \(b\) into units of currency \(q\). Let \(V_b\) and \(V_q\) denote the amounts of each currency held by us, and let \(x_{b\rightarrow q}\) denote the amount of currency \(b\) exchanged for currency \(j\). Following the transaction \(x_{b\rightarrow q}\) we have the following changes to the currency holdings

where \(a_{b\rightarrow q}\) is a conversion coefficient equal to the price of \(b\) expressed in terms of currency \(q\). The capacity \(c_{b\rightarrow q}\) of a trading along edge \(b\rightarrow q\) is specified by a relationship

Because the arcs in our graph correspond to two types of orders - bid and ask - we need to build a consistent way of expressing them in our \(a_{b\rightarrow q}\), \(c_{b\rightarrow q}\) notation. Imagine now that we are the party that accepts the buy and ask bids existing in the graph.

For bid orders, we have the opportunity to convert the base currency \(b\) into the quote currency \(q\), for which we will use the following notation:

An ask order for symbol \(b/q\) is an order to sell the base currency at a price not less than the ‘ask’ price given in terms of the quote currency. The ask volume is the amount of base currency to be sold. For us, a sell order is an opportunity to convert the quoted currency into the base currency such that

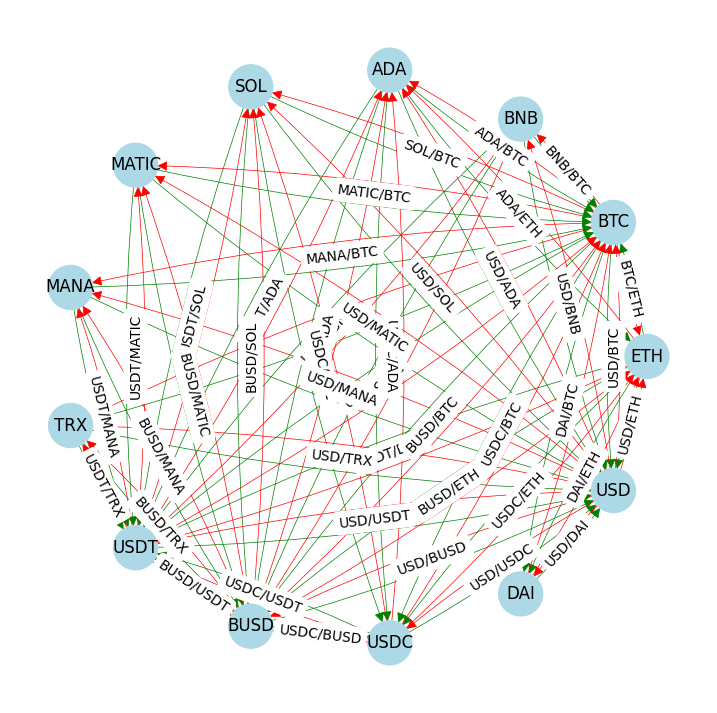

The following cell creates a directed graph using data from an exchange order book. To distinguish between different order types, we will highlight the big orders with green color, and ask orders with red color.

def order_book_to_dg(order_book):

# create a dictionary of edges index by (src, dst)

dg_order_book = nx.DiGraph()

# loop over each order in the order book dataframe

for order in order_book.index:

# if the order is a 'bid', i.e., an order to purchase the base currency

if not np.isnan(order_book.at[order, "bid_volume"]):

src = order_book.at[order, "base"]

dst = order_book.at[order, "quote"]

# add an edge to the graph with the relevant attributes

dg_order_book.add_edge(

src,

dst,

kind="bid",

a=order_book.at[order, "bid_price"],

capacity=order_book.at[order, "bid_volume"],

weight=-np.log(order_book.at[order, "bid_price"]),

color="g",

width=0.5,

)

# if the order is an 'ask', i.e., an order to sell the base currency

if not np.isnan(order_book.at[order, "ask_volume"]):

src = order_book.at[order, "quote"]

dst = order_book.at[order, "base"]

# add an edge to the graph with the relevant attributes

dg_order_book.add_edge(

src,

dst,

kind="ask",

a=1.0 / order_book.at[order, "ask_price"],

capacity=order_book.at[order, "ask_volume"]

* order_book.at[order, "ask_price"],

weight=-np.log(1.0 / order_book.at[order, "ask_price"]),

color="r",

width=0.5,

)

# loop over each node in the graph and set the color attribute to "lightblue"

for node in dg_order_book.nodes():

dg_order_book.nodes[node]["color"] = "lightblue"

return dg_order_book

order_book_dg = order_book_to_dg(order_book)

First, we simply print the content of the order book as a list of arcs.

# display contents of the directed graph

print(f"src --> dst kind a c")

print(f"------------------------------------------------------")

for src, dst in order_book_dg.edges():

print(

f"{src:5s} --> {dst:5s} {order_book_dg.edges[(src, dst)]['kind']}"

+ f"{order_book_dg.edges[(src, dst)]['a']: 16f} {order_book_dg.edges[(src, dst)]['capacity']: 16f} "

)

src --> dst kind a c

------------------------------------------------------

ETH --> BTC bid 0.069735 0.012000

ETH --> ADA ask 4668.534080 0.190981

ETH --> USDT bid 1630.200000 0.950000

ETH --> BUSD bid 1630.210000 0.510000

ETH --> USDC bid 1630.160000 0.100000

ETH --> DAI bid 1629.890000 0.497400

ETH --> USD bid 1630.490000 2.564550

BTC --> ETH ask 14.335068 0.003488

BTC --> BNB ask 78.403701 0.038263

BTC --> ADA ask 66844.919786 0.032433

BTC --> SOL ask 1068.261938 0.014154

BTC --> MATIC ask 19391.118868 0.007746

BTC --> MANA ask 36968.576710 0.038113

BTC --> TRX ask 335570.469799 0.075549

BTC --> USDT bid 23373.920000 0.118619

BTC --> BUSD bid 23371.440000 0.021500

BTC --> USDC bid 23371.660000 0.020000

BTC --> DAI bid 23366.440000 0.049540

BTC --> USD bid 23373.010000 0.007463

BNB --> BTC bid 0.012743 0.050000

BNB --> USDT bid 297.857700 0.800000

BNB --> BUSD bid 297.763000 1.670000

BNB --> USD bid 297.900200 2.100000

ADA --> BTC bid 0.000015 2.000000

ADA --> ETH bid 0.000214 994.900000

ADA --> USDT bid 0.348630 1100.000000

ADA --> BUSD bid 0.348000 6582.900000

ADA --> USDC bid 0.348200 8615.400000

ADA --> USD bid 0.348800 1500.000000

SOL --> BTC bid 0.000935 1.420000

SOL --> USDT bid 21.857000 22.870000

SOL --> BUSD bid 21.830000 1.390000

SOL --> USDC bid 21.830000 343.520000

SOL --> USD bid 21.858100 55.730000

MATIC --> BTC bid 0.000052 26.200000

MATIC --> USDT bid 1.203000 1664.600000

MATIC --> BUSD bid 1.203410 623.100000

MATIC --> USD bid 1.204000 937.600000

MANA --> BTC bid 0.000027 831.000000

MANA --> USDT bid 0.631000 157.000000

MANA --> BUSD bid 0.630700 343.000000

MANA --> USD bid 0.631000 372.340000

TRX --> BTC bid 0.000003 4.000000

TRX --> USDT bid 0.069280 10824.900000

TRX --> BUSD bid 0.069290 10823.900000

TRX --> USD bid 0.069200 225602.200000

USDT --> BTC ask 0.000043 1058.348400

USDT --> ETH ask 0.000613 815.385000

USDT --> BNB ask 0.003357 238.313520

USDT --> ADA ask 2.867384 178.281000

USDT --> BUSD ask 1.000400 317048.859708

USDT --> SOL ask 0.045738 502.860500

USDT --> USDC ask 0.999800 299240.836200

USDT --> MATIC ask 0.829876 6513.748000

USDT --> MANA ask 1.581778 360.986200

USDT --> TRX ask 14.423770 750.053538

USDT --> USD bid 1.000000 10407.870000

BUSD --> USDT bid 0.999500 293433.930000

BUSD --> BTC ask 0.000043 502.601845

BUSD --> BNB ask 0.003356 399.256350

BUSD --> ETH ask 0.000613 415.843800

BUSD --> MATIC ask 0.830192 499.884100

BUSD --> USDC ask 1.000000 279879.620000

BUSD --> MANA ask 1.582028 1930.433400

BUSD --> ADA ask 2.865330 347.953000

BUSD --> SOL ask 0.045662 3965.871000

BUSD --> TRX ask 14.411298 1750.043556

BUSD --> USD bid 0.999500 79157.800000

USDC --> USDT bid 1.000100 307657.000000

USDC --> BUSD bid 0.999900 329027.800000

USDC --> BTC ask 0.000043 1192.226490

USDC --> ETH ask 0.000613 350.624150

USDC --> SOL ask 0.045704 4399.630400

USDC --> ADA ask 2.862049 850.125140

USDC --> USD bid 0.999900 5050.300000

DAI --> BTC ask 0.000043 1158.020820

DAI --> ETH ask 0.000613 2431.396900

DAI --> USD bid 0.999100 4534.660000

USD --> BTC ask 0.000043 1140.900820

USD --> ETH ask 0.000613 946.970718

USD --> USDT ask 0.999900 954935.163968

USD --> BNB ask 0.003356 399.852255

USD --> ADA ask 2.866151 1046.700000

USD --> BUSD ask 1.000100 795513.920652

USD --> MATIC ask 0.830220 1129.218750

USD --> USDC ask 1.000000 517682.170000

USD --> MANA ask 1.583281 361.489944

USD --> DAI ask 0.999900 7592.579182

USD --> SOL ask 0.045733 399.927311

USD --> TRX ask 14.409222 15562.637700

Next, we draw the graph itself.

draw_dg(order_book_dg, 0.05)

plt.show()

Trading and arbitrage#

With this unified treatment of bid and ask orders, we are ready to formulate the mathematical problem of finding an arbitrage opportunity. An arbitrage exists if it is possible to find a closed path and a sequence of transactions in the directed graph resulting in a net increase in currency holdings. Given a path

the path is closed if \(i_n = i_0\). The path has finite capacity if each edge in the path has a non-zero capacity. For a sufficiently small holding \(w_{i_0}\) of currency \(i_0\) (because of capacity constraints), a closed path with \(i_0 = i_n\) represents an arbitrage opportunity if

If all we care about is simply finding an arbitrage cycle, regardless of the volume traded, we can use one of the many shortest path algorithms from the networkx library. To convert the problem of finding a path meeting the above condition into a sum-of-terms to be minimized, we can take the negative logarithm of both sides to obtain the condition:

In other words, if we assign the negative logarithm as the weight of arcs in a graph, then our problem just becomes translated into the problem of searching for a cycle with a total sum of weights along it to be negative.

Find order books that have arbitrage opportunities#

A simple cycle is a closed path in which no node appears twice. Simple cycles are distinct if they are not cyclic permutations (essentially, the same set of nodes but with a different start and end points) of each other. One could check for arbitrage opportunities by checking if there are any negative simple cycles in the graph.

However, searching for a negative-weight cycle through searching for an arbitrage opportunity can be a daunting task - a brute-force search over all simple cycles has complexity \((n + e)(c + 1)\) which is impractical for large-scale applications. A more efficient search based on the Bellman-Ford algorithm is embedded in the NetworkX function negative_edge_cycle that returns a logical True if a negative cycle exists in a directed graph.

order_book_dg = order_book_to_dg(order_book)

nx.negative_edge_cycle(order_book_dg, weight="weight", heuristic=True)

True

The function negative_edge_cycle is fast, but it only indicates if there is a negative cycle or not, and we don’t even know what kind of a cycle is it so it would be hard to use that information to perform an arbitrage.

Luckily, the networkx library includes the function find_negative_cycle that locates a single negative edge cycle if one exists. We can use this to demonstrate the existence of an arbitrage opportunity and to highlight that opportunity on the directed graph of all possible trades. The following cell reports the cycle found and the corresponding trading return measured in basis points (1 basis point = 0.01%). The same trading cycle is marked with thicker arcs in the graph.

def sum_weights(cycle):

return sum(

[

order_book_dg.edges[edge]["weight"]

for edge in zip(cycle, cycle[1:] + cycle[:1])

]

)

order_book_dg = order_book_to_dg(order_book)

arb = nx.find_negative_cycle(order_book_dg, weight="weight", source="USD")[:-1]

bp = 10000 * (np.exp(-sum_weights(arb)) - 1)

for src, dst in zip(arb, arb[1:] + arb[:1]):

order_book_dg[src][dst]["width"] = 5

print(

f"Trading cycle with {len(list(arb))} trades: {' --> '.join(list(arb))}\nReturn = {bp:6.3f} basis points "

)

ax = draw_dg(order_book_dg, 0.05)

plt.show()

Trading cycle with 3 trades: USDC --> USDT --> BUSD

Return = 5.002 basis points

Note this may or may not be the trading cycle with maximum return. There may be other cycles with higher or lower returns, and that allow higher or lower trading volumes.

Brute force search arbitrage with simple cycles#

Not all arbitrage cycles are the same - some yield a higher relative return (per dollar invested) than the others, and some yield a higher absolute return (maximum amount of money to be made risk-free) than others. This is because the amount of money that flows through a negative cycle is upper bounded by the size of the smallest order in that cycle. Thus, if one is looking for the best possible arbitrage sequence of trades, finding just ‘a cycle’ might not be enough.

A crude way to search for a good arbitrage opportunity would be to enumerate all possible simple cycles in a graph and pick the one that’s best according to whatever criterion we pick. A brute force search over for all simple cycles has order \((N_{nodes} + N_{edges})(N_{cycles} + 1)\) complexity, which is prohibitive for large order books. Nevertheless, we explore this option here to better understand the problem of finding and valuing arbitrage opportunities.

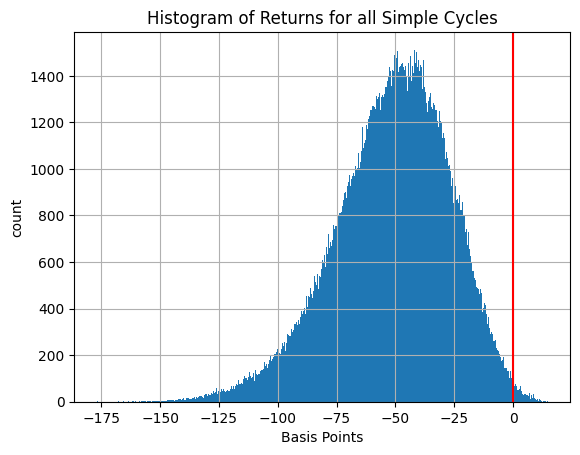

In the following cell, we compute the loss function for all simple cycles that can be constructed within a directed graph using the function simple_cycles from the networkx library to construct a dictionary of all distinct simple cycles in the order book. Each cycle is represented by an ordered list of nodes. For each cycle, the financial return is computed, and a histogram is constructed to show the distribution of potential returns. Several paths with the highest return are then overlaid on the graph of the order book.

Again, note that no account is taken of the trading capacity available on each path.

The next cell iterates over all simple cycles in a directed graph. This can take a long time for a large dense graph.

# convert order book to a directed graph

order_book_dg = order_book_to_dg(order_book)

# compute the sum of weights given a list of nodes

def sum_weights(cycle):

return sum(

[

order_book_dg.edges[edge]["weight"]

for edge in zip(cycle, cycle[1:] + cycle[:1])

]

)

# create a dictionary of all simple cycles and sum of weights

cycles = {

tuple(cycle): 10000 * (np.exp(-sum_weights(cycle)) - 1)

for cycle in nx.simple_cycles(order_book_dg)

}

print(

f"There are {len(cycles)} distinct simple cycles in the order book, {len([cycle for cycle in cycles if cycles[cycle] > 0])} of which have positive return."

)

# create histogram

plt.hist(cycles.values(), bins=int(np.sqrt(len(cycles))))

ax = plt.gca()

ax.set_ylabel("count")

ax.set_xlabel("Basis Points")

ax.set_title("Histogram of Returns for all Simple Cycles")

ax.grid(True)

ax.axvline(0, color="r")

plt.show()

There are 203147 distinct simple cycles in the order book, 974 of which have positive return.

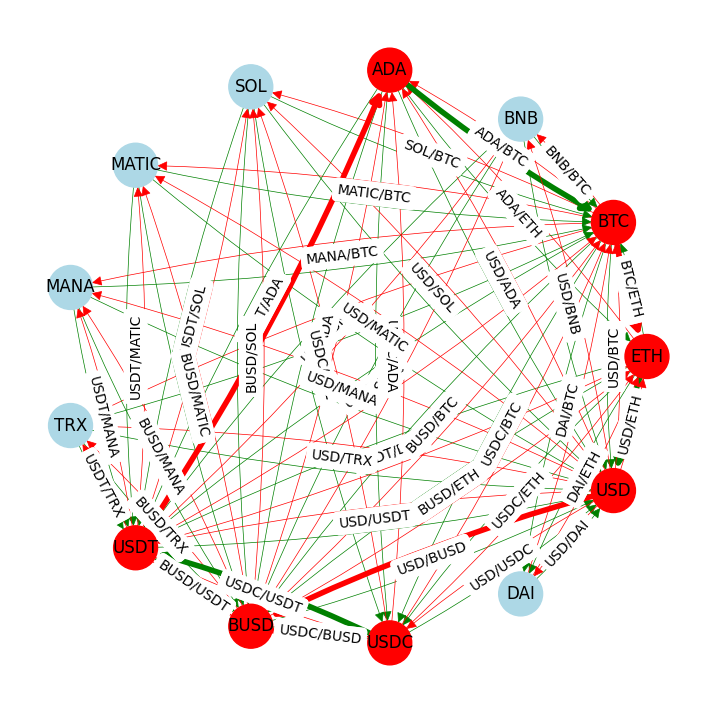

Next, we sort out the negative cycles from this list and present them along with their basis-points (1% is 100 basis points) return.

arbitrage = [

cycle for cycle in sorted(cycles, key=cycles.get, reverse=True) if cycles[cycle] > 0

]

n_cycles_to_list = 5

print(f"Top {n_cycles_to_list}\n")

print(f"Basis Points Arbitrage Cycle")

for cycle in arbitrage[0 : min(n_cycles_to_list, len(arbitrage))]:

t = list(cycle)

t.append(cycle[0])

print(f"{cycles[cycle]:6.3f} {len(t)} trades: {' --> '.join(t)}")

Top 5

Basis Points Arbitrage Cycle

14.774 8 trades: USDT --> ADA --> BTC --> ETH --> USD --> BUSD --> USDC --> USDT

14.747 8 trades: USDT --> TRX --> BTC --> ETH --> USD --> BUSD --> USDC --> USDT

14.699 7 trades: USDT --> ADA --> BTC --> USD --> BUSD --> USDC --> USDT

14.673 7 trades: USDT --> TRX --> BTC --> USD --> BUSD --> USDC --> USDT

13.772 7 trades: USDT --> ADA --> BTC --> ETH --> USD --> USDC --> USDT

In the end, we draw an example arbitrage cycle on our graph to illustrate the route that the money must travel.

n_cycles_to_show = 1

for cycle in arbitrage[0 : min(n_cycles_to_show, len(arbitrage))]:

print(

f"Trading cycle with {len(t)} trades: {' --> '.join(t)}\nReturn = {cycles[cycle]:6.3f} basis points "

)

# get fresh graph to color nodes

order_book_dg = order_book_to_dg(order_book)

# color nodes red

for node in cycle:

order_book_dg.nodes[node]["color"] = "red"

# makes lines wide

for edge in zip(cycle, cycle[1:] + cycle[:1]):

order_book_dg.edges[edge]["width"] = 4

ax = draw_dg(order_book_dg, rad=0.05)

t = list(cycle)

t.append(cycle[0])

plt.show()

Trading cycle with 8 trades: USDT --> ADA --> BTC --> ETH --> USD --> BUSD --> USDC --> USDT

Return = 14.774 basis points

Pyomo model for arbitrage with capacity constraints#

The preceding analysis demonstrates some practical limitations of relying on generic implementations of network algorithms:

First, more than one negative cycle may exist, so more than one arbitrage opportunity may exist, i.e. an optimal strategy consists of a combination of cycles.

Secondly, simply searching for a negative cycle using shortest path algorithms does not account for capacity constraints, i.e., the maximum size of each of the exchanges. For that reason, one may end up with a cycle on which a good `rate’ of arbitrage is available, but where the absolute gain need not be large due to the maximum amounts that can be traded.

Instead, we can formulate the problem of searching for a maximum-gain arbitrage via linear optimization. Assume that we are given a directed graph where each edge \(i\rightarrow j\) is labeled with a ‘multiplier’ \(a_{i\rightarrow j}\) indicating how many units of currency \(j\) will be received for one unit of currency \(i\), and a ‘capacity’ \(c_{i\rightarrow j}\) indicating how many units of currency \(i\) can be converted to currency \(j\).

We break the trading process into steps indexed by \(t = 1, 2, \ldots, T\), where currencies are exchanged between two adjacent nodes in a single step. We denote by \(x_{i\rightarrow j}(t)\) the amount of currency traded from node \(i\) to \(j\) in step \(t\). In this way, we start with the amount \(w_{USD}(0)\) at time \(0\) and aim to maximize the amount \(w_{USD}(T)\) at time \(T\). Denote by \(O_j\) the set of nodes to which outgoing arcs from \(j\) lead, and by \(I_j\) the set of nodes from which incoming arcs lead.

A single transaction converts \(x_{i\rightarrow j}(t)\) units of currency \(i\) to currency \(j\). Following all transactions at event \(t\), the trader will hold \(v_j(t)\) units of currency \(j\) where

For every edge \(i\rightarrow j\), the sum of all transactions must satisfy

The objective of the optimization model is to find a sequence of currency transactions that increase the holdings of a reference currency. The solution is constrained by assuming that the trader cannot short sell any currency. The resulting model is

where the constraints model:

the initial amount condition,

the balance equations linking the state of the given node in the previous and subsequent time periods,

the fact that we cannot trade at time step \(t\) more of a given currency than we had in this currency from time step \(t - 1\). This constraint ‘enforces’ the time order of trades, i.e., we cannot trade in time period \(t\) units which have been received in the same time period.

the maximum allowed trade volumes,

the non-negativity of the variables.

The following cell implements this optimization model using Pyomo.

def crypto_model(order_book_dg, T=10, v0=100.0):

m = pyo.ConcreteModel("Cryptocurrency arbitrage")

# length of the trading chain

m.T0 = pyo.RangeSet(0, T)

m.T1 = pyo.RangeSet(1, T)

# currency nodes and trading edges

m.NODES = pyo.Set(initialize=list(order_book_dg.nodes))

m.EDGES = pyo.Set(initialize=list(order_book_dg.edges))

# currency on hand at each node

m.v = pyo.Var(m.NODES, m.T0, domain=pyo.NonNegativeReals)

# amount traded on each edge at each trade

m.x = pyo.Var(m.EDGES, m.T1, domain=pyo.NonNegativeReals)

# total amount traded on each edge over all trades

m.z = pyo.Var(m.EDGES, domain=pyo.NonNegativeReals)

# "multiplier" on each trading edge

@m.Param(m.EDGES)

def a(m, src, dst):

return order_book_dg.edges[(src, dst)]["a"]

@m.Param(m.EDGES)

def c(m, src, dst):

return order_book_dg.edges[(src, dst)]["capacity"]

@m.Objective(sense=pyo.maximize)

def wealth(m):

return m.v["USD", T]

@m.Constraint(m.EDGES)

def total_traded(m, src, dst):

return m.z[src, dst] == sum([m.x[src, dst, t] for t in m.T1])

@m.Constraint(m.EDGES)

def edge_capacity(m, src, dst):

return m.z[src, dst] <= m.c[src, dst]

# initial assignment of v0 units on a selected currency

@m.Constraint(m.NODES)

def initial(m, node):

if node == "USD":

return m.v[node, 0] == v0

return m.v[node, 0] == 0

@m.Constraint(m.NODES, m.T1)

def no_shorting(m, node, t):

out_nodes = [dst for src, dst in m.EDGES if src == node]

return m.v[node, t - 1] >= sum(m.x[node, dst, t] for dst in out_nodes)

@m.Constraint(m.NODES, m.T1)

def balances(m, node, t):

in_nodes = [src for src, dst in m.EDGES if dst == node]

out_nodes = [dst for src, dst in m.EDGES if src == node]

return m.v[node, t] == m.v[node, t - 1] + sum(

m.a[src, node] * m.x[src, node, t] for src in in_nodes

) - sum(m.x[node, dst, t] for dst in out_nodes)

return m

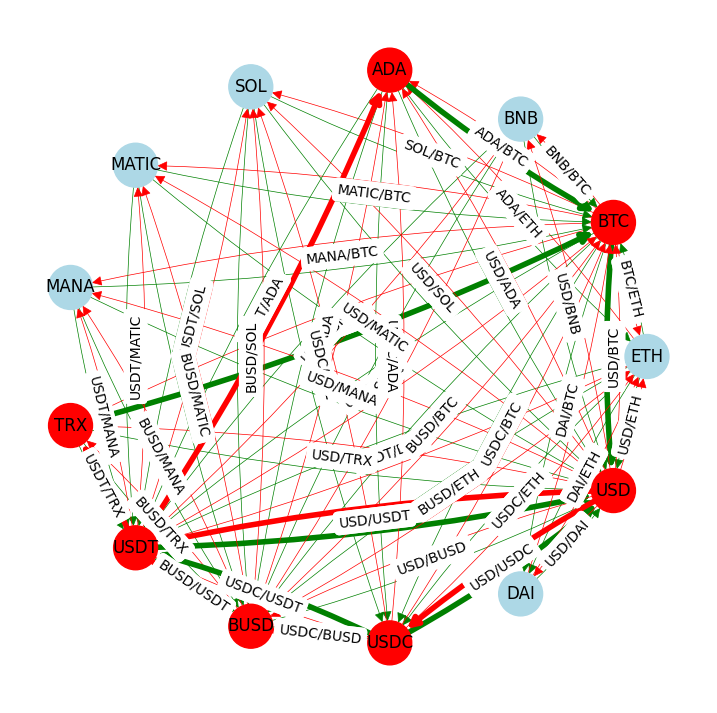

Using this function, we are able to compute the optimal (absolute) return from an order book while respecting the order capacities and optimally using all the arbitrage opportunities inside it.

order_book_dg = order_book_to_dg(order_book)

v0 = 10000.0

T = 8

m = crypto_model(order_book_dg, T=T, v0=v0)

SOLVER.solve(m)

vT = m.wealth()

print(f"Starting wealth = {v0:0.2f} USD")

print(f"Weath after {T:2d} transactions = {vT:0.2f} USD")

print(f"Return = {10000 * (vT - v0)/v0:0.3f} basis points")

Starting wealth = 10000.00 USD

Weath after 8 transactions = 10009.01 USD

Return = 9.006 basis points

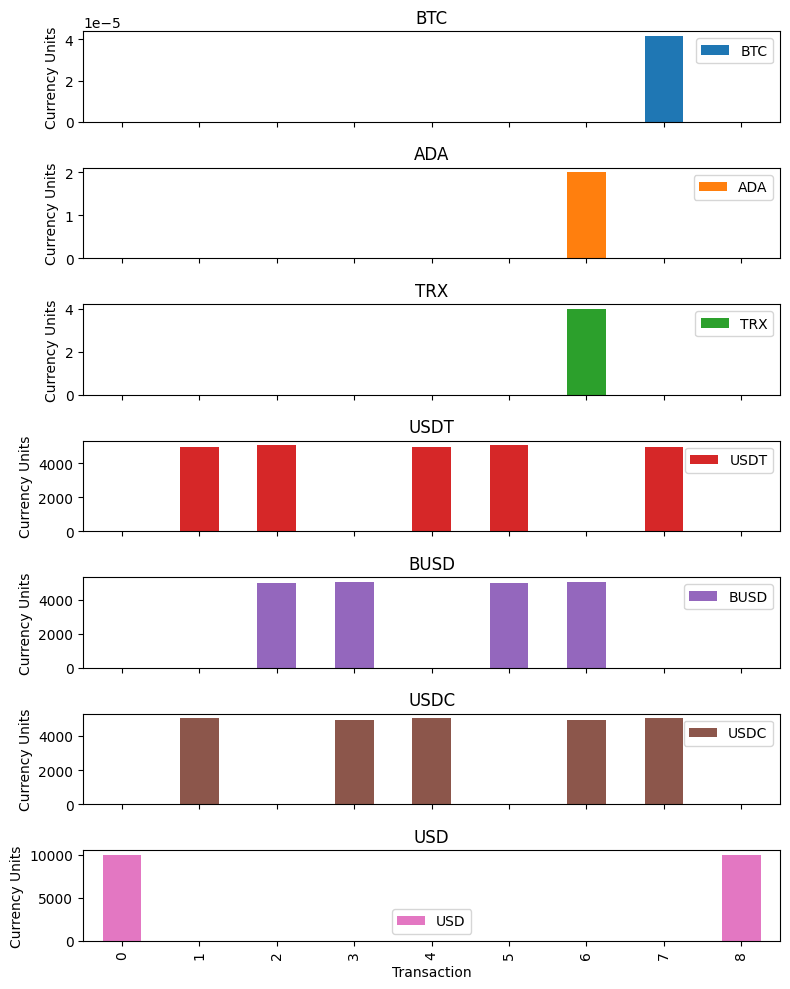

To track the evolution of the trades throughout time, the script in the following cell illustrates, for each currency (rows) the amount of money held in that currency at each of the time steps \(t = 0, \dots, 8\). It is visible from this scheme that the sequence of trades is not a simple cycle, but rather a more sophisticated sequence of trades which we would not have discovered with simple-cycle exploration alone, especially not when considering also the arc capacities.

for node in m.NODES:

print(f"{node:5s}", end="")

for t in m.T0:

print(f" {m.v[node, t]():11.5f}", end="")

print()

ETH 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

BTC 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00004 0.00000

BNB 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

ADA 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 2.00000 0.00000 0.00000

SOL 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

MATIC 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

MANA 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

TRX 0.00000 0.00000 -0.00000 -0.00000 0.00000 0.00000 4.00000 -0.00000 0.00000

USDT 0.00000 4953.27900 5046.73030 0.00000 4955.75660 5049.25470 0.00000 4958.23550 0.00000

BUSD 0.00000 -0.00000 4955.26110 5048.74980 0.00000 4957.73970 5050.30000 0.00000 0.00000

USDC 0.00000 5046.22570 0.00000 4955.26110 5048.74980 0.00000 4957.73970 5050.30000 0.00000

DAI 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000 0.00000

USD 10000.00000 -0.00000 0.00000 0.00000 0.00000 -0.00000 0.00000 0.00000 10009.00600

To be even more specific, the following cell lists the sequence of transcations executed.

print("\nTransaction Events")

for t in m.T1:

print(f"t = {t}")

for src, dst in m.EDGES:

if m.x[src, dst, t]() > 1e-6:

print(

f" {src:8s} -> {dst:8s}: {m.x[src, dst, t]():14.6f} {m.a[src, dst] * m.x[src, dst, t]():14.6f}"

)

print()

Transaction Events

t = 1

USD -> USDT : 4953.774300 4953.278972

USD -> USDC : 5046.225700 5046.225700

t = 2

USDT -> BUSD : 4953.279000 4955.261104

USDC -> USDT : 5046.225700 5046.730323

t = 3

USDT -> BUSD : 5046.730300 5048.749800

BUSD -> USDC : 4955.261100 4955.261100

t = 4

BUSD -> USDC : 5048.749800 5048.749800

USDC -> USDT : 4955.261100 4955.756626

t = 5

USDT -> BUSD : 4955.756600 4957.739696

USDC -> USDT : 5048.749800 5049.254675

t = 6

USDT -> ADA : 0.697500 2.000000

USDT -> BUSD : 5048.279900 5050.300020

USDT -> TRX : 0.277320 4.000000

BUSD -> USDC : 4957.739700 4957.739700

t = 7

ADA -> BTC : 2.000000 0.000030

TRX -> BTC : 4.000000 0.000012

BUSD -> USDC : 5050.300000 5050.300000

USDC -> USDT : 4957.739700 4958.235474

t = 8

BTC -> USD : 0.000042 0.976057

USDT -> USD : 4958.235500 4958.235500

USDC -> USD : 5050.300000 5049.794970

We next illustrate the arbitrage strategy in the graph by marking all the corresponding arcs thicker.

# for each currency we took only one ask and one bid, this is why we are unique between each pair of nodes

# report what orders to issue

for src, dst in m.EDGES:

if m.z[src, dst]() > 0.0000002:

order_book_dg.nodes[src]["color"] = "red"

order_book_dg.nodes[dst]["color"] = "red"

order_book_dg[src][dst]["width"] = 4

draw_dg(order_book_dg, 0.05)

plt.show()

If we want to be even more precise about the execution of the trading strategy, we can formulate a printout of the list of orders that we, as the counter party to the orders stated in the order book, should issue for our strategy to take place.

# report what orders to issue

print("Trading Summary for the Order Book")

print(f" Order Book Type Capacity Traded")

for src, dst in m.EDGES:

if m.z[src, dst]() > 0.0000002:

kind = order_book_dg.edges[(src, dst)]["kind"]

s = f"{src:>5s} -> {dst:<5s} {kind} {m.c[src, dst]:12.5f} {m.z[src, dst]():14.5f}"

s += " >>> "

if kind == "ask":

base = dst

quote = src

symbol = base + "/" + quote

price = 1.0 / order_book_dg.edges[(src, dst)]["a"]

volume = m.z[src, dst]() / price

s += f"sell {volume:15.6f} {symbol:11s} at {price:12.6f}"

if kind == "bid":

base = src

quote = dst

symbol = base + "/" + quote

price = order_book_dg.edges[(src, dst)]["a"]

volume = m.z[src, dst]()

s += f"buy {volume:16.6f} {symbol:11s} at {price:12.6f}"

print(s)

Trading Summary for the Order Book

Order Book Type Capacity Traded

BTC -> USD bid 0.00746 0.00004 >>> buy 0.000042 BTC/USD at 23373.010000

ADA -> BTC bid 2.00000 2.00000 >>> buy 2.000000 ADA/BTC at 0.000015

TRX -> BTC bid 4.00000 4.00000 >>> buy 4.000000 TRX/BTC at 0.000003

USDT -> ADA ask 178.28100 0.69750 >>> sell 2.000000 ADA/USDT at 0.348750

USDT -> BUSD ask 317048.85971 20004.04600 >>> sell 20012.050820 BUSD/USDT at 0.999600

USDT -> TRX ask 750.05354 0.27732 >>> sell 4.000000 TRX/USDT at 0.069330

USDT -> USD bid 10407.87000 4958.23550 >>> buy 4958.235500 USDT/USD at 1.000000

BUSD -> USDC ask 279879.62000 20012.05100 >>> sell 20012.051000 USDC/BUSD at 1.000000

USDC -> USDT bid 307657.00000 20007.97600 >>> buy 20007.976000 USDC/USDT at 1.000100

USDC -> USD bid 5050.30000 5050.30000 >>> buy 5050.300000 USDC/USD at 0.999900

USD -> USDT ask 954935.16397 4953.77430 >>> sell 4953.278972 USDT/USD at 1.000100

USD -> USDC ask 517682.17000 5046.22570 >>> sell 5046.225700 USDC/USD at 1.000000

In the end, we can illustrate the time-journey of our balances in different currencies using time-indexed bar charts.

# display currency balances

balances = pd.DataFrame()

for node in order_book_dg.nodes:

if sum(m.v[node, t]() for t in m.T0) > 0.0000002:

for t in m.T0:

balances.loc[t, node] = m.v[node, t]()

balances.plot(

kind="bar",

subplots=True,

figsize=(8, 10),

xlabel="Transaction",

ylabel="Currency Units",

)

plt.gcf().tight_layout()

plt.show()

Exercises for the reader#

The previous notebook cells made certain assumptions that we need to consider. The first assumption was that there was at most one bid and one ask order between any pair of currencies in an exchange. This assumption was based on the number of orders we downloaded from the online database, but in reality, there may be more orders. How would the presence of multiple orders per pair affect our graph formulation? How can we adjust the MILO formulation to account for this?

Another assumption was that we only traded currencies within one exchange. However, in reality, we can trade across multiple exchanges. How can we modify the graph-based problem formulation to accommodate this scenario?

Further, we have assigned no cost to the number of trades required to implement the strategy produced by optimization. How can the modeled be modified to either minimize the number of trades, or to explicitly include trading costs?

Finally, a tool like this needs to operate in real time. How can this model be incorporated into, say, a streamlit application that could be used to monitor for arbitrage opportunities in real time?

Real Time Downloads of Order Books from an Exchange#

The goal of this notebook was to show how network algorithms and optimization can be utilized to detect arbitrage opportunities within an order book that has been obtained from a cryptocurrency exchange.

The subsequent cell in the notebook utilizes ccxt.exchange.fetch_order_book to obtain the highest bid and lowest ask orders from an exchange for market symbols that meet the criteria of having a minimum in-degree for their base currencies.

def get_order_book(exchange, exchange_dg):

def get_orders(base, quote, limit=1):

result = exchange.fetch_order_book("/".join([base, quote]), limit)

if not result["asks"] or not result["bids"]:

result = None

else:

result["base"], result["quote"] = base, quote

result["timestamp"] = exchange.milliseconds()

result["bid_price"], result["bid_volume"] = result["bids"][0]

result["ask_price"], result["ask_volume"] = result["asks"][0]

return result

# fetch order book data and store in a dictionary

order_book = filter(

lambda r: r is not None,

[get_orders(base, quote) for quote, base in exchange_dg.edges()],

)

# convert to pandas dataframe

order_book = pd.DataFrame(order_book)

order_book["timestamp"] = pd.to_datetime(order_book["timestamp"], unit="ms")

return order_book[

[

"symbol",

"timestamp",

"base",

"quote",

"bid_price",

"bid_volume",

"ask_price",

"ask_volume",

]

]

minimum_in_degree = 10

# get graph of market symbols with mininum_in_degree for base currencies

exchange_dg = get_exchange_dg(exchange, minimum_in_degree)

# get order book for all markets in the graph

order_book = get_order_book(exchange, exchange_dg)

order_book_dg = order_book_to_dg(order_book)

# find trades

v0 = 10000.0

m = crypto_model(order_book_dg, T=12, v0=v0)

vT = m.wealth()

print(f"Potential Return = {10000*(vT - v0)/v0:0.3f} basis points")

display(order_book)

Potential Return = 0.000 basis points

| symbol | timestamp | base | quote | bid_price | bid_volume | ask_price | ask_volume | |

|---|---|---|---|---|---|---|---|---|

| 0 | ETH/BTC | 2023-10-26 10:28:07.688 | ETH | BTC | 0.0534 | 1.00000 | 0.0535 | 1.01680 |

| 1 | BTC/USDT | 2023-10-26 10:28:07.785 | BTC | USDT | 34422.5300 | 0.04934 | 34450.7000 | 0.00128 |

| 2 | ETH/USDT | 2023-10-26 10:28:08.017 | ETH | USDT | 1840.2700 | 1.07030 | 1841.6900 | 2.09630 |

| 3 | BAT/USDT | 2023-10-26 10:28:08.118 | BAT | USDT | 0.2032 | 659.00000 | 0.2044 | 804.00000 |

| 4 | ETC/USDT | 2023-10-26 10:28:08.213 | ETC | USDT | 16.5500 | 6.27000 | 16.8500 | 0.10000 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 143 | BTC/USDC | 2023-10-26 10:28:29.614 | BTC | USDC | 34358.6800 | 0.00504 | 34467.3700 | 0.00290 |

| 144 | ETH/USDC | 2023-10-26 10:28:29.712 | ETH | USDC | 1834.3500 | 1.11010 | 1862.0600 | 0.21520 |

| 145 | BTC/DAI | 2023-10-26 10:28:29.828 | BTC | DAI | 33763.7400 | 0.00030 | 35062.9500 | 0.00030 |

| 146 | ETH/DAI | 2023-10-26 10:28:30.036 | ETH | DAI | 1635.0100 | 0.02700 | 1872.4900 | 0.00120 |

| 147 | USDT/USD | 2023-10-26 10:28:30.430 | USDT | USD | 1.0000 | 4030.00000 | 1.0006 | 620.00000 |

148 rows × 8 columns

The following cell can be used to download additional order book data sets for testing.

from datetime import datetime

import time

# get graph of market symbols with mininum_in_degree for base currencies

minimum_in_degree = 5

exchange_dg = get_exchange_dg(exchange, minimum_in_degree)

# search time

search_time = 20

timeout = time.time() + search_time

# threshold in basis points

arb_threshold = 1.0

# wait for arbitrage opportunity

print(f"Search for {search_time} seconds.")

while time.time() <= timeout:

print("Basis points = ", end="")

order_book = get_order_book(exchange, exchange_dg)

order_book_dg = order_book_to_dg(order_book)

v0 = 10000.0

m = crypto_model(order_book_dg, T=12, v0=10000)

vT = m.wealth()

bp = 10000 * (vT - v0) / vT

print(f"{bp:0.3f}")

if bp >= arb_threshold:

print("arbitrage found!")

fname = f"{exchange} orderbook {datetime.utcnow().strftime('%Y%m%d_%H%M%S')}.csv".replace(

" ", "_"

)

order_book.to_csv(fname)

print(f"order book saved to: {fname}")

print("Search complete.")

Search for 20 seconds.

Basis points = 0.149

Search complete.

Bibliographic Notes#

Crytocurrency markets are relatively new compared to other markets, and relatively few academic papers are available that specifically address arbitrage on those markets. Early studies, such as the following, reported periods of large, recurrent arbitrage opportunities that exist across exchanges, and that can persist for several days or weeks.

Makarov, I., & Schoar, A. (2020). Trading and arbitrage in cryptocurrency markets. Journal of Financial Economics, 135(2), 293-319.

Subsequent work reports these prices differentials do exist, but only at a fraction of the values previously reported, and only for fleeting periods of time.

Crépellière, T., & Zeisberger, S. (2020). Arbitrage in the Market for Cryptocurrencies. Available at SSRN 3606053. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3606053

The use of network algorithms to identify cross-exchange arbitrage has appeared in the academic literature, and in numerous web sites demonstrating optimization and network applications. Representative examples are cited below.

Peduzzi, G., James, J., & Xu, J. (2021, September). JACK THE RIPPLER: Arbitrage on the Decentralized Exchange of the XRP Ledger. In 2021 3rd Conference on Blockchain Research & Applications for Innovative Networks and Services (BRAINS) (pp. 1-2). IEEE. https://arxiv.org/pdf/2106.16158.pdf

Bruzgė, R., & Šapkauskienė, A. (2022). Network analysis on Bitcoin arbitrage opportunities. The North American Journal of Economics and Finance, 59, 101562. https://doi.org/10.1016/j.najef.2021.101562

Bruzgė, R., & Šapkauskienė, A. (2022). Dataset for Bitcoin arbitrage in different cryptocurrency exchanges. Data in Brief, 40, 107731.

The work in this notebook is related to materials found in the following web resources.

A more complete analysis of trading and exploiting arbitrage opportunities in decentralized finance markets is available in the following paper and thesis.

Byrne, S. An Exploration of Novel Trading and Arbitrage Methods within Decentralised Finance. https://www.scss.tcd.ie/Donal.OMahony/bfg/202021/StephenByrneDissertation.pdf

Levus, R., Berko, A., Chyrun, L., Panasyuk, V., & Hrubel, M. (2021). Intelligent System for Arbitrage Situations Searching in the Cryptocurrency Market. In CEUR Workshop Proceedings (pp. 407-440). http://ceur-ws.org/Vol-2917/paper32.pdf

In addition to the analysis of arbitrage opportunities, convex optimization may also have an important role in the developing of trading algorithms for crypocurrency exchanges.

Angeris, G., Agrawal, A., Evans, A., Chitra, T., & Boyd, S. (2021). Constant function market makers: Multi-asset trades via convex optimization. arXiv preprint arXiv:2107.12484. https://baincapitalcrypto.com/constant-function-market-makers-multi-asset-trades-via-convex-optimization/ and https://arxiv.org/pdf/2107.12484.pdf