6.3 Markowitz portfolio optimization revisited#

Preamble: Install Pyomo and a solver#

This cell selects and verifies a global SOLVER for the notebook.

If run on Google Colab, the cell installs Pyomo and ipopt, then sets SOLVER to use the ipopt solver. If run elsewhere, it assumes Pyomo and the Mosek solver have been previously installed and sets SOLVER to use the Mosek solver via the Pyomo SolverFactory. It then verifies that SOLVER is available.

import sys, os

if 'google.colab' in sys.modules:

%pip install idaes-pse --pre >/dev/null 2>/dev/null

!idaes get-extensions --to ./bin

os.environ['PATH'] += ':bin'

solver = "ipopt"

else:

solver = "mosek_direct"

import pyomo.environ as pyo

SOLVER = pyo.SolverFactory(solver)

assert SOLVER.available(), f"Solver {solver} is not available."

from IPython.display import Markdown, HTML

import numpy as np

import matplotlib.pyplot as plt

Problem description and model formulation#

Consider again the Markowitz portfolio optimization we presented earlier in Chapter 5. Recall that the matrix \(\Sigma\) describes the covariance among the uncertain return rates \(r_i\), \(i=1,\dots, n\). Since \(\Sigma\) is positive semidefinite by definition, it allows for a Cholesky factorization, namely \(\Sigma = B B^\top\). We can then rewrite the quadratic constraint as \(\|B^\top x \|_2 \leq \gamma\) and thus as \((\gamma, B^\top x) \in \mathcal{L}^{n+1}\) using the Lorentz cone. In this way, we realize that the original portfolio problem we formulated earlier is in fact a conic quadratic optimization problem, which can thus be solved faster and more reliably. The optimal solution of that problem was the one with the maximum expected return while allowing for a specific level \(\gamma\) of risk.

However, an investor could aim for a different trade-off between return and risk and formulate a slightly different optimization problem, namely

where \(\alpha \geq 0\) is a risk tolerance parameter that describes the relative importance of return vs. risk for the investor. The risk, quantified by the variance of the investment return \(x^\top \Sigma x = x^\top B^\top B x\), appears now in the objective function as a penalty term. Note that even in this new formulation we have a conic problem since we can rewrite it as

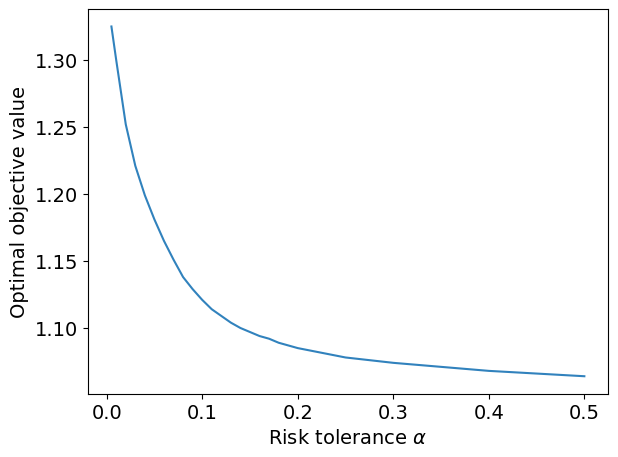

Solving for all values of \(\alpha \geq 0\), one can obtain the so-called efficient frontier.

# Specify the initial capital, the risk tolerance, and the guaranteed return rate.

C = 1

alpha = 0.1

R = 1.05

# Specify the number of assets, their expected return, and their covariance matrix.

n = 3

mu = np.array([1.25, 1.15, 1.35])

Sigma = np.array([[1.5, 0.5, 2], [0.5, 2, 0], [2, 0, 5]])

# Check that Sigma is semi-definite positive

assert np.all(np.linalg.eigvals(Sigma) >= 0)

# When changing the covariance matrix Sigma, ensure you input a semi-definite positive one.

# The easiest way to generate a random covariance matrix is first generating a random

# m x m matrix A and then taking the matrix A^T A (which is always semi-definite positive)

# m = 3

# A = np.random.rand(m, m)

# Sigma = A.T @ A

#

# Moreover, in practive such a matrix A, called factor, can be low-rank,

# see https://docs.mosek.com/modeling-cookbook/qcqo.html#example-factor-model.

# This would provide better numerical properties for the proper conic formulation

# y=Ax, |y|^2 <= s,

# corresponding to the mathematical formulation above.

def markowitz_revisited(alpha, mu, Sigma):

model = pyo.ConcreteModel("Markowitz portfolio optimization revisited")

model.xtilde = pyo.Var(domain=pyo.NonNegativeReals)

model.x = pyo.Var(range(n), domain=pyo.NonNegativeReals)

model.s = pyo.Var(domain=pyo.NonNegativeReals)

@model.Objective(sense=pyo.maximize)

def objective(m):

return mu @ m.x + R * m.xtilde - alpha * m.s

@model.Constraint()

def bounded_variance(m):

return (m.x @ (Sigma @ m.x)) <= m.s

@model.Constraint()

def total_assets(m):

return sum(m.x[i] for i in range(n)) + m.xtilde == C

return model

model = markowitz_revisited(alpha, mu, Sigma)

result = SOLVER.solve(model)

display(

Markdown(

f"**Solver status:** *{result.solver.status}, {result.solver.termination_condition}*"

)

)

display(

Markdown(

f"**Solution:** $\\tilde x = {model.xtilde.value:.3f}$, $x_1 = {model.x[0].value:.3f}$, $x_2 = {model.x[1].value:.3f}$, $x_3 = {model.x[2].value:.3f}$"

)

)

display(Markdown(f"**Maximizes objective value to:** ${model.objective():.2f}$"))

Solver status: ok, optimal

Solution: $\tilde x = 0.283$, $x_1 = 0.478$, $x_2 = 0.130$, $x_3 = 0.109$

Maximizes objective value to: $1.12$

alpha_values = [

0.005,

0.01,

0.02,

0.03,

0.04,

0.05,

0.06,

0.07,

0.08,

0.09,

0.1,

0.11,

0.12,

0.13,

0.14,

0.15,

0.16,

0.17,

0.18,

0.19,

0.20,

0.25,

0.3,

0.4,

0.5,

]

objective = []

plt.rcParams.update({"font.size": 14})

for alpha in alpha_values:

model = markowitz_revisited(alpha, mu, Sigma)

SOLVER.solve(model)

objective.append(round(model.objective(), 3))

plt.plot(alpha_values, objective, color=plt.cm.tab20c(0))

plt.xlabel(r"Risk tolerance $\alpha$")

plt.ylabel("Optimal objective value")

plt.tight_layout()

plt.show()